If you’re interested in real estate and researching rental property investments, there are three types of residential opportunities to consider:

- Short-term rentals: Vacation rentals like Vrbo and Airbnb

- Mid-term rentals: One- to six-month rentals for traveling workers and students, such as those listed on websites like Furnished Finder

- Long-term rentals: Traditional approach with annual or multiyear leases on single-family houses, condos and apartments

While Visio Lending offers mortgage financing for all three use cases, this guide focuses on the proven success of long-term investment properties. Through our Debt-Service Coverage Ratio (DSCR) loan, we help real estate investors of all experience levels qualify for mortgages by leveraging the property’s performance as an asset rather than using personal finances for eligibility.

Ready to learn how you can scale your real estate investment portfolio? Join us as we explore the ins and outs of DSCR loans for long-term rentals and how they compare to traditional financing methods. We’ll also highlight important considerations to determine if DSCR fits your investment strategy.

What Are Long-Term Rental Loans?

Long-term rental loans are mortgage options for real estate investors seeking financing on a property with an annual or multiyear lease. While investors can choose from various loan types, many prefer DSCR loans, which eliminate the need for personal income verification and rely on the earning potential of the asset.

Why Invest in Long-Term Rental Loans With Visio?

Long-term rental loans are ideal for investors following a buy-and-hold strategy, where the goal is to generate consistent, predictable cash flow through long-term leases. Our DSCR loans provide favorable financing terms, low interest rates and simplified qualification requirements, allowing investors to scale their rental portfolios without the burden of personal income verification.

Benefits of long-term rental loans

Our DSCR loan program provides real estate investors with:

- 30-year fixed terms (no balloon payments)

- No personal income verification (qualification based on property cash flow)

- Entity borrowing options (borrow under an LLC or corporation)

- Scalability (finance multiple properties with flexible portfolio limits, subject to executive approval for higher thresholds)

How Do Long-Term Rentals Work?

To fully understand DSCR loans for long-term rentals, we’ll compare them to traditional financing options. While investors have several ways to finance long-term rental properties, DSCR loans often provide the most flexibility and scalability for rental investors. We’ve broken down each loan type into three sections:

- Who: The typical investor who uses this loan type

- How it works: The basics of how the loan functions

- Why investors choose it: The key reasons this loan is a good fit

Conventional mortgage loan

- Who: Homeowners or small-scale investors looking to purchase a rental property while meeting traditional mortgage criteria

- How: Qualification requires a 20% down payment and personal financial verification, including tax returns, W-2s and a debt-to-income (DTI) ratio assessment

- Why: Lower interest rates and familiar loan structures, but harder to qualify for multiple properties due to income verification requirements

Conventional mortgage loans require personal income verification, including tax returns, W-2s and DTI calculations. While they offer lower interest rates, they come with stricter lending standards than DSCR loans. Additionally, DTI limitations can make them less scalable for investors with large portfolios, as they may cap the number of financed properties.

DSCR loans

- Who: Real estate investors looking to buy, refinance or scale a long-term rental portfolio without personal income verification

- How: Qualification is based on the property’s rental income, calculated using the DSCR metric—not the investor’s personal income or tax returns

- Why: Investors can scale portfolios more easily, borrow under an LLC and secure long-term financing with flexible terms

DSCR loans qualify investors based on the property’s cash flow rather than personal income, eliminating the need for tax returns or W-2s. Unlike other loan types, they offer 30-year fixed terms with no balloon payments.

Additionally, investors can borrow under an LLC for liability protection and use these loans to purchase, refinance or take out cash for additional property acquisitions.

Hard money loan

- Who: Experienced investors needing quick access to capital for property acquisitions or distressed asset purchases

- How: Approval is based on the property’s asset value rather than income, with higher interest rates and shorter repayment terms (typically between six and 36 months)

- Why: Ideal for investors with a clear exit strategy, whether flipping a property or using short-term financing before refinancing into a long-term loan

Hard money loans provide fast access to funding, but their high interest rates and short terms make them a better fit for fix-and-flips or temporary financing rather than a long-term solution.

Short-Term vs. Long-Term Rentals

There is no one-size-fits-all approach to residential real estate investing. A long-term rental strategy may be suitable for you, while short-term rentals might work for others. When deciding which avenue to pursue or if you’re considering a mix of both, it’s important to understand the key differences to choose the strategy that best aligns with your goals.

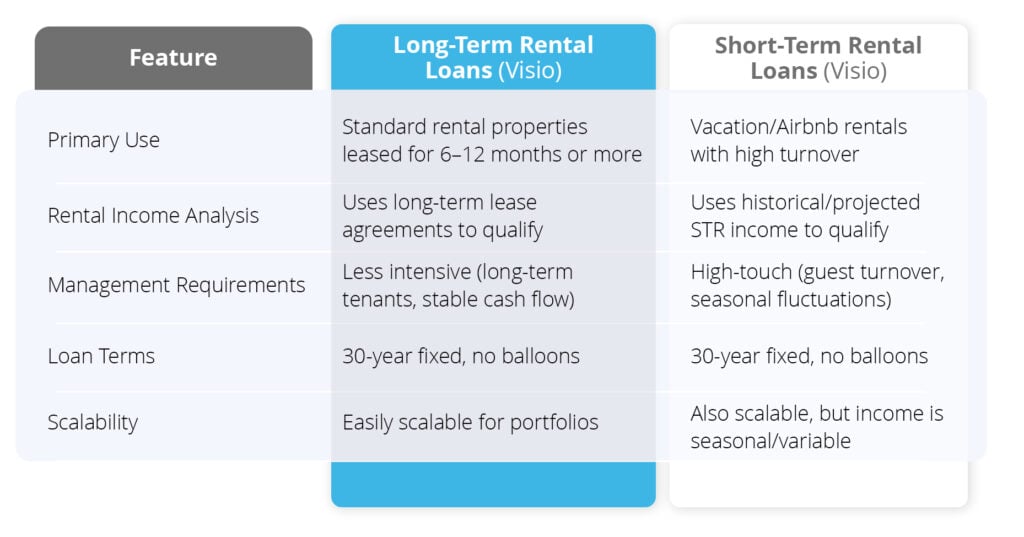

While short- and long-term rental loans share similar DSCR financing structures, here’s how they differ:

Revenue and operating costs

One of the most appealing aspects of short-term rentals is the ability to generate more revenue than long-term rentals. Depending on location, seasonality and market conditions, short-term rentals can generate more gross revenue than their long-term counterparts. However, cash flow can be unpredictable due to fluctuating demand and higher operating costs.

On the other hand, long-term rentals have been a go-to strategy for real estate investors for decades, offering stable and predictable cash flow. With leases typically lasting a year or more, owners can take the time to vet quality tenants. In return, operating costs stay low, and day-to-day management is minimal.

Bottom line: Short-term rentals can have higher earning potential but require a more hands-on approach. Long-term rentals provide a predictable income and can be viewed as a “set it and forget it” solution.

Regulations

Long-term rentals have significantly fewer regulations compared to short-term rentals. Depending on the vacation rental location, owners might have to pay a premium on specific licenses, taxes and zoning compliance. Additionally, many HOAs restrict owners from turning their properties into short-term rentals for various reasons, including disruption to the community. Alternatively, long-term rentals are easier to manage since they typically follow standard landlord-tenant laws.

Qualification criteria

Visio uses a DSCR loan for both short- and long-term rental properties. DSCR is calculated by dividing the monthly rental income of a property by its monthly debt obligations.

DSCR = Monthly Rent ÷ Principal, Interest, Taxes, Insurance and Association Dues (PITIA)

DSCR loans for short-term rentals are assessed using historical rental income, such as Airbnb statements, or market-based projections if the property lacks a rental history. Conversely, DSCR loans for long-term rentals are based on the standard lease agreement and market rents.

How To Prepare for a Long-Term Rental Loan

Visio’s qualification requirements are straightforward. Investors can follow four steps to ensure success.

1. Do your research

Compare different rental markets before choosing a property. The goal is to find which state, region and neighborhood provide the greatest opportunity for consistent rental income and property appreciation.

Consider key factors such as:

- Median rents and occupancy rates for long-term leases

- Tenant demand (e.g., near universities, job centers, or transit hubs)

- Local landlord-tenant laws

- Property taxes and insurance costs that can impact profitability

Calculate projected cash flow, ROI and DSCR to ensure your investment is profitable.

2. Prepare for the down payment

Down payment requirements for DSCR loans on a long-term rental property may vary by lender. However, you can generally expect to put down between 20% and 30% of the property’s purchase price. If your credit is less than stellar, you may be asked for a 35% down payment.

3. Make sure your property meets funding requirements

DSCR loans for long-term rental properties are evaluated based on tenant leases and market rents. Before applying, it’s important to ensure your property meets these minimum criteria:

- Minimum property value: $150,000

- Minimum loan amount: $75,000

- Minimum credit score: 680

- Stable rental income projections based on local market rents

- No bankruptcies in the last four years and no foreclosures in the last three years

4. Gather necessary documentation

Since tax returns and pay stubs aren’t required when applying for a DSCR loan, lenders require different types of documentation, which include:

- One form of ID for each guarantor

- Voided check

- Insurance declaration page

- Lender’s title insurance policy

- Business entity documents (if borrowing through a company)

- HOA contact information (if applicable)

- Current lender details (for both cash-out refinances/rate and term)

- Purchase contract

- Any addenda to the purchase contract

Additionally, a property appraisal is required to confirm rental market value and ensure DSCR thresholds are met.

5. Ensure the property is rent-ready

For long-term rental loans, the property must be habitable and meet standard rental market expectations. Lenders typically require:

- C4 condition or better

- No major deferred maintenance issues that could impact rental value

- Tenant-ready features, such as working utilities, appliances, and essential repairs completed

If the property needs extensive renovations, it may not qualify for standard long-term rental financing and might require a fix-and-flip loan or hard money loan before refinancing into a DSCR loan.

Long-Term Rental Loan FAQs

What is a long-term rental loan?

Long-term rental loans refer to mortgages used on investment properties with leases lasting a year or more. Real estate investors can choose traditional financing, such as conventional loans, which generally require a 20% down payment. On the other hand, you can opt for alternative financing with a DSCR loan, which leverages the property’s performance as an asset rather than viewing personal income to determine eligibility.

What types of properties qualify for long-term rental loans?

While accepted property types may vary by lender, long-term rental loans are generally used for single-family homes (SFRs), condos, townhomes and small multi-unit properties (2-4 units). Some lenders may also finance apartment buildings, but multi-family properties usually require commercial financing.

How do DSCR loans for long-term rentals work?

DSCR loans allow the investor to finance through LLCs, partnerships and limited partnerships to fund their long-term rental property. DSCR is a metric used by lenders to qualify borrowers based on the rental property’s income, not their personal income. DSCR is calculated by dividing the monthly rent by the property’s principal, interest, taxes, insurance and HOA dues (PITIA).

What is the minimum DSCR required to qualify?

While DSCR qualifications may vary by lender, a one or higher is generally the minimum. A DSCR of one means the property’s income equals its expenses. However, some lenders may qualify borrowers with a DSCR of less than one, but additional reserves and a higher down payment are usually required. Investors should target a DSCR of at least 1.2, while 1.5 or higher is considered excellent. With DSCR, the rule is simple—the higher, the better.

How do long-term rental loans compare to short-term rental loans?

The qualification process for DSCR loans for short- and long-term rental properties differs slightly. Here is how the evaluation process changes depending on the type of rental:

- Long-term rental loans: DSCR is determined by the standard lease agreement and market rents

- Short-term rentals: The property is assessed by using historical rental income, such as Airbnb statements, or market-based projections if the property lacks a rental history.

What are the benefits of using a DSCR loan for long-term rentals?

Residential real estate investors are drawn to DSCR loans for various reasons, including the following:

- No personal income verification (approval based on property cash flow)

- 30-year fixed terms (no balloon payments)

- Scalability (finance multiple properties with flexible portfolio limits, subject to executive approval for higher thresholds)

- Borrow under an LLC or corporation for liability protection

How much down payment is required for a long-term rental loan?

The down payment requirements may vary by lender, but borrowers are generally asked to put between 20% and 25% of the property’s purchase price down. If your credit is less than stellar, you may be asked for as much as 35% down.

Can I refinance a long-term rental property with a DSCR loan?

Yes, investors can use DSCR loans to refinance existing rental properties, either to lower their interest rate, extend loan terms or take out cash for additional property investments.

Do I need tax returns or W-2s to qualify?

DSCR loans don’t require borrowers to submit W-2s, tax returns or personal income verification. Instead, the property’s rental income is the primary factor in loan approval.

What documentation is required for a long-term rental loan?

Since tax returns and pay stubs aren’t required when applying for a long-term rental loan, DSCR lenders require different types of documentation, which include:

- One form of ID for each guarantor

- Voided check

- Insurance declaration page

- Lender’s title insurance policy

- Property appraisal

- Business entity documents (if borrowing through a company)

- HOA contact information (if applicable)

- Current lender details (for both cash-out/rate and term refinances)

- Purchase contract

- Any addenda to the purchase contract

Can I use a long-term rental loan to finance multiple properties?

Yes. Unlike conventional loans that limit the number of financed properties, DSCR loans allow investors to scale their portfolios without traditional lending caps.

How long does it take to close a long-term rental loan?

Closing times may vary based on various factors, such as lender and appraisal timelines, but generally, DSCR loans close anywhere between three and five weeks.

Are there prepayment penalties on long-term rental loans?

Some lenders may institute a prepayment penalty on their long-term rental loans. With a prepayment penalty, lenders may charge a fee for paying off the loan early. These fees are generally within the first three to five years of the loan’s life.

What are the best locations for long-term rental investing?

Look for markets with:

- Strong rental demand (near job hubs, universities or transit)

- High occupancy rates (low tenant turnover)

- Landlord-friendly laws (easier eviction processes, tax benefits, etc.)

What credit score do I need to qualify?

Most lenders require a minimum credit score of 680 to qualify for a DSCR loan. Borrowers with scores greater than 700 often qualify for better terms, including lower down payments and favorable interest rates.