.png?width=600&height=338&name=1%20-%20Blog%20Feature%20Image%20Dump%20(4).png)

When it comes to applying for a loan, the higher your credit score, the better. Lenders not only use credit scores to evaluate loan eligibility, but also to determine interest rates and credit limits. Bottom line: higher credit score equals lower interest rates and more credit. In addition to helping you borrow money, there are several other reasons to aim for a high credit score.

In this post, we'll take a look at what makes a good credit score, why it matters, how you can improve your score, and credit score for real estate investors, including Visio's credit requirements.

What Makes a Good Credit Score?

Credit scores range from 300 to 850. Where a person falls on this scale will tell a lender a lot about their financial behavior and risk. Generally speaking, a score under 600 is considered bad, and borrowers within this range will have difficulty obtaining a loan. 740 and above is considered very good and will help you attain the best rates possible.

However, you don't need to have 740+ to get decent rates. The 700-720 range is often where lenders start offering more attractive rates.

Why Your Credit Score Matters

The most well-known reason your credit score is important is for loan qualification. However, there are other reasons to improve your credit. Let’s take a look.

Credit Score Indicates to Lenders Your Ability to Pay Back the Loan

You may be wondering why lenders care so much about your score. Imagine this: Say you've got some extra cash that you'd like to lend and make a return on. A potential client comes to you with a 550 credit score and wants to borrow $10,000. Anything below a 600 indicates this person's score is low is due to late or missing payments and/or outstanding balances. Would you feel comfortable risking your $10,000 with this client?

Conversely, how would you feel about your odds when lending $15,000 to someone with a 720? Chances are you'd probably feel more comfortable lending more money to someone with a proven track record of timely and complete payments than you would a smaller amount to someone with the opposite track record.

Credit Score Helps You Obtain Lower Insurance Rates

According to the National Association of Insurance Commissioners, credit also affects how much you pay for insurance. Insurers use credit-based insurance scores to determine your premium.

Your Credit Score is Necessary for Establishing Utility Services in Your Name

Many utility providers, such as electric, gas, phone, water, or cable, will waive cash deposits for people with good credit when you go to pay your utility bills. Further, the Federal Trade Commission states “Like other creditors, utility companies will ask for information like your Social Security number so they can check your credit history. A good credit history can make it easier for you to get services. A poor credit history can make it harder.”

Your Credit Score is Necessary for Getting a Cell Phone Contract

Transunion Credit Bureau says “Buying a cell phone is just one more reason to get in the know about your credit.” People with poor credit could be stuck with a pay-as-you-go cell phone plan because most phone companies won’t give them a contract.

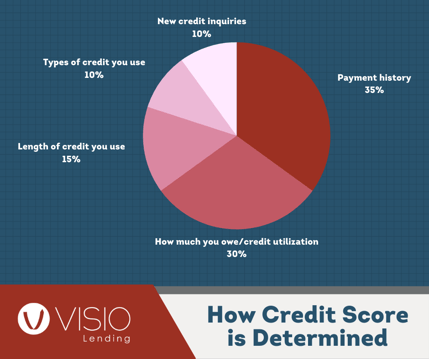

How Credit Score is Determined

Understanding your credit score can help you learn how to improve it. According to The Motley Fool, FICO determines your score based on the following categories:

- Payment history: 35%

- How much you owe/credit utilization: 30%

- Length of credit you use: 15%

- Types of credit you use: 10%

- New credit inquiries: 10%

Payment History

Payment history takes into account how many late payments a person has, but in the most recent update from FICO, it rates based on whether late payments are a pattern or an anomaly. So basically, that one-time late payment to your credit card shouldn't ding you too hard. Still, with payment history making up 35% of your score, paying on time, over time, is an absolute must.

Credit Utilization

Credit utilization ratio is the ratio of how much credit you owe versus how much you still have available to use. Things like carrying high balances on a credit card could hurt you here, as it indicates you may be stretching your limits. At 30% of your score, it is worth evaluating your accounts to find the balance between using credit to build history, but not over-using it.

Credit History

Credit history length not only refers to how long it's been since you first started building credit, but it also takes into account the length of time each type of credit has been open. Even though older accounts that are still open — but not recently in use — don't necessarily help your score, closing them is often not a good idea either. Keep an eye on when you opened certain accounts, and this 15% of your score shouldn't cause too much trouble.

Types of Credit Usage

As far as types of credit you use, FICO notices but doesn't really care what the mix is (i.e. credit cards versus auto loans). What does matter here is that obtaining financing in different areas, such as auto, mortgage, retail credit, may yield different results due to each industry having its own standards for creditworthiness. Fortunately, at just 10% of the total score, this one is not as important to worry about as other factors.

New Credit Inquiries

Lastly, there is the category of new credit inquiries. Often given a bad rap of dinging credit, this element is luckily only given 10% weight in determining credit score. Another positive is that FICO takes into account rate shopping, so applying for an auto loan a few times in a short period isn't going to wreck your score. What might have an effect, though, is applying for multiple credit cards over a short period, but even that won't dramatically affect your overall score.

How to Improve Your Credit Score

One foolproof way to improve your credit score is simply to pay your bills on time, since payment history is so essential. Set an alarm on your calendar so you don't forget. Or even better, enable autopay. Some other ideas include:

Check Your Credit Reports for Errors

Before you go about improving your credit score, it is a good idea to know where you stand with the three major credit bureaus. Once a year, you can obtain a free credit report from each of them: Experian, Equifax, and TransUnion. Carefully look through your credit report to make sure there are no inaccuracies.

Use an Online App to Monitor Your Credit Score

Online apps such as CreditKarma and Mint are free and trustworthy ways to regularly monitor your credit score. A huge benefit is that these apps give you personalized ways to improve your individual credit score in your situation.

Increase your Line of Credit

One way to lower your credit utilization is to increase your line of credit (LOC). However, you should avoid opening a new LOC because it will trigger a new credit inquiry and lower the average age of your accounts — both of which ding your score. Instead, focus on doing this with your current LOCs. Simply ask your current credit card issuers to increase the limit on your cards. Many will approve you for a small increase without a significant negative impact on your credit.

Credit Score for Real Estate Investors

Credit score is particularly important for real estate investors looking to build a portfolio of rental properties. Mortgage lenders care greatly about credit scores. You need to at least be able to meet the minimum credit score requirements for a mortgage loan, but a good credit score will help you get a better interest rate. Here is a look at some of the mortgage loan lender types available to real estate investors.

FHA Loans

Governed by the Federal Housing Administration, an FHA mortgage loan will have the lowest interest rates, yet the most stringent requirements. The current Fannie Mae Eligibility Matrix lists a minimum credit score of 620. However, even if you meet the minimum credit score, you must have a high debt-to-income ratio, high down payment, and your available credit is limited.

Hard Money Loans

Hard money loans are the easiest to qualify for with the lowest credit score requirements. However, with hard money loans you can expect a higher interest rate and short loan term. Even if you have a higher credit score, hard money loans will be expensive and short-term.

Home Equity Credit Lines

If you have a primary residence, you can use a home equity loan to borrow against the equity and purchase an investment property. This also requires you to have a high credit score. Keep in mind, your primary residence will be used as collateral when obtaining a home equity loan. It is essential that you keep up with each monthly mortgage payment in order to keep your home.

A Private Money Loan

A private lender or alternative lender tends to be the sweet spot for real estate investors. You will need excellent credit, yet the other qualifications are related to property income rather than personal cash flow. This kind of mortgage loan might have a high interest rate, but you should be able to easily pay it with the cash flow from your rental property. Also with this kind of lender, the higher credit score you have, the better your interest rate will be. We are a private lender, and in the next section we will discuss our credit score requirements.

Visio’s Credit Score Requirements

At Visio, we use a tri-merged credit report and either use the middle score of three scores or the lower score of two scores. Our minimum credit score is 680. Some of our other credit requirements include:

- No open foreclosure or bankruptcy

- No bankruptcy in the past four years

- No foreclosures, short sales, or deeds in lieu within the last three years

- No mortgage lates in the past 12 months

Visio Lending also uses credit score tiers. Credit scores over 760 get the best interest rate. Other factors affect your rate including the DSCR and LTV.

Familiarize Yourself with Credit Score

Knowledge is power. Knowing where you stand and how to improve your credit score can have a significant financial impact. Take our quiz to see how credit score savvy you are: