This blog post has been updated May 2024 for freshness and accuracy

Real estate investing can be a lucrative endeavor and a great way to diversify your assets. The term real estate investing is also quite broad. It could mean everything from investing in real estate investment trusts (REITS) to owning income producing real estate, whether residential or commercial. For new investors, here is an overview on how to become a successful real estate investor, through different approaches.

Ways to Invest in Real Estate

As we stated, real estate investing has many shapes and sizes. Here are some popular methods:

Residential Rental Properties

Through this method, real estate investors purchase single-family homes and rent them out to tenants. They can either rent these properties out long-term or short-term like an Airbnb. Residential rental properties can provide a steady stream of rental income and will appreciate in value over time. It can also be a great source of passive income when outsourced to a property manager or it can be hands on work if you manage everything yourself. The key to this strategy is to ensure that you are bringing in positive cash flow, meaning your income is higher than your expenses.

Commercial Real Estate

Through this method, real estate investors are investing in commercial properties such as office buildings, retail spaces, warehouses, or industrial facilities. These properties can generate rental income from businesses as tenants. It can be quite lucrative and a great way to build cash flow, yet it is very involved and requires significant upfront money and due diligence.

Real Estate Investment Trusts (REITs):

REITs are a great entry point to real estate investing, especially for those looking to become a real estate investor today without substantial upfront money. Similar to investing in the stock market, through REITs, you invest in publicly traded companies that own and manage income producing real estate properties. Investing in REITs enables investors to buy and sell shares of real estate investment portfolios, providing a source of dividends and potential for capital appreciation.

Real Estate Crowd Funding

This real estate investment strategy involves an investor pooling money with other investors through an online platform to invest in larger real estate projects. Like REITs, crowd funding is a way to become a real estate investor without investing significant money upfront. There are some great platforms to get started, including Crowdstreet, Fundrise, RealtyMogul, among many others.

Other methods include fix and flip real estate investing, wholesaling, and through real estate partnerships and syndications.

How to Become a Real Estate Investor- Basic Steps

To start investing, here are some basic steps you can take.

1. Educate Yourself

Before you dive in, learn about the various types of real estate investments, including residential rental property, fix and flip investment property, commercial real estate, and others. Understand real estate terminology, financing options, and local market dynamics. Also, read books, take online courses, attend some real estate business seminars, and consider joining local real estate investment associations.

Understanding of the real estate market will help formulate your real estate investment strategy.

2. Establish Your Financial Foundation and Business Plan

Determine how much money you have to start and set your budget for real estate investments. If you have significant working capital, you could consider buying rental property. For any kind of rental property, you will need a down payment, closing costs, repair costs, and either property management costs or tenant management costs.

If you do not have enough money to purchase an investment property, your initial investment strategy could start with a REIT or consider working with business partners.

3. Start Small & Thoroughly Learn Your Housing Market

If you decide to start off the bat purchasing investment properties, consider starting with one property. Successful investors take the time to initially find the right property, learn their local market, establish a solid plan, and figure out what works best for them. Real estate investing comes with inherent risks that can be costly. That’s why many experienced investors started small and worked their way up to acquire more investment properties.

4. Build a Real Estate Network

Successful real estate investors are well connected in the real estate industry. They establish relationships with real estate agents, contractors, property management companies, motivated sellers, lenders, and other industry professionals.

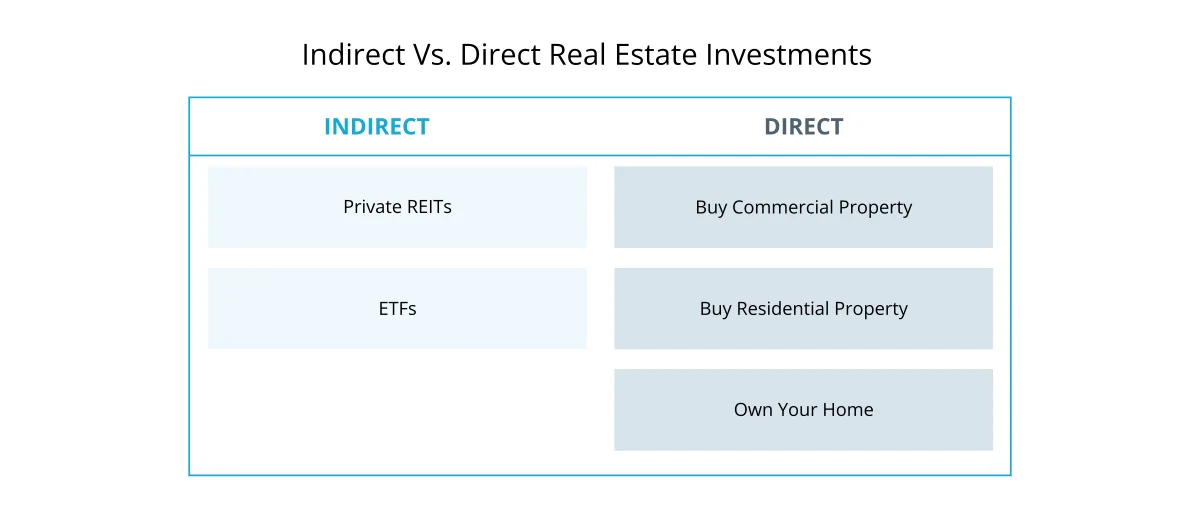

How to Become a Real Estate Investor by Indirectly Owning Property

Becoming a real estate investor through Real Estate Investment Trusts (REITs) or online platforms is a relatively straightforward way many investors enter the real estate market without owning physical investment properties. Here is how to start investing.

Understand the REIT and Online Platform Basics

Learn what a REIT is and how it operates. REITs come in various types, including equity REITs, mortgage REITs (mREITs), and hybrid REITs. Each type has its focus and investment strategies, so understand which one aligns with your financial goals.

Conduct Market Research

Evaluate the real estate investment opportunities and determine the types of properties or sectors you want to invest in. REITs can specialize in various segments, like residential apartments, office buildings, retail spaces, healthcare, and more.

Select Your Platform and Start Investing

To invest in REITs, you’ll need a brokerage account. Choose a reputable online brokerage that offers access to a wide range of REITs. Some popular options include E*TRADE, Fidelity, and Charles Schwab. Once you pick a platform, research and select REITs that align with your investment goals and risk tolerance. Look for REITs with a strong track record, solid management teams, and properties in markets you believe have potential for growth.

Monitor and Adjust as Necessary

Keep an eye on your real estate investments, monitor the performance of your chosen REITs, and stay informed about the current real estate conditions. Look for more investment opportunities as you get comfortable, and consider working with a financial advisor to fully optimize your real estate investments.

How to Become a Real Estate Investor by Directly Acquiring Property

It requires more money and time, yet directly owning real property is a great way to achieve financial freedom. Take these steps to become a real estate investment owner.

Choose Your Niche

Decide on the type of real estate investment or sale you want to pursue, such as rental properties, fix-and-flip, commercial real estate, or wholesaling.

Identify Your Market and Find a Property

Analyze the local market you would like to target. Look for areas with growth potential and opportunities for your chosen niche. Thoroughly understand property values, rent trends, and demographic shifts.

Once you have identified a market, search for a property that meet your investment criteria. Conduct due diligence by evaluating the property’s condition, legal status, and potential for rental income or appreciation.

Secure Financing

Secure financing, whether through a mortgage, cash purchase, DSCR loan or other methods. Negotiate the purchase price and terms with the seller.

Maintain & Improve

Regularly maintain your properties to keep them in good condition and potentially increase their value. Continuously assess your investment portfolio and adjust your strategy as necessary to meet your goals.

Conclusion

Before investing in real estate, it’s essential to conduct thorough research, assess your financial situation and risk tolerance, and consider your investment goals to determine which method aligns best with your objectives. Additionally, consulting with financial advisors or experienced real estate investors and professionals can help you make informed decisions in this investment sector.