In addition to a down payment, closing costs are a significant element of a home purchase. These expenses cover the labor required to complete a real estate transaction and are provided on the closing date.

Read on to find out who pays closing costs and a breakdown of expenses on both sides of the closing table.

What Are Closing Costs?

Closing costs are fees you pay upfront on closing day to compensate the professionals who assist in the closing process.

Closing costs include attorney fees, appraisal fees, transfer taxes, and origination fees. The commission for any real estate agent involved in the sale is typically included in this price, too.

How Much Are Closing Costs?

Typically, closing costs are a percentage of the home’s purchase price. Buyers and sellers cover closing costs, though what their closing fees encompass are slightly different.

Typical closing costs for the buyer vary between 3% and 6% of the total loan amount. For the seller, they are typically between 6% and 10% of the purchase price.

Does the Buyer or Seller Pay Closing Costs?

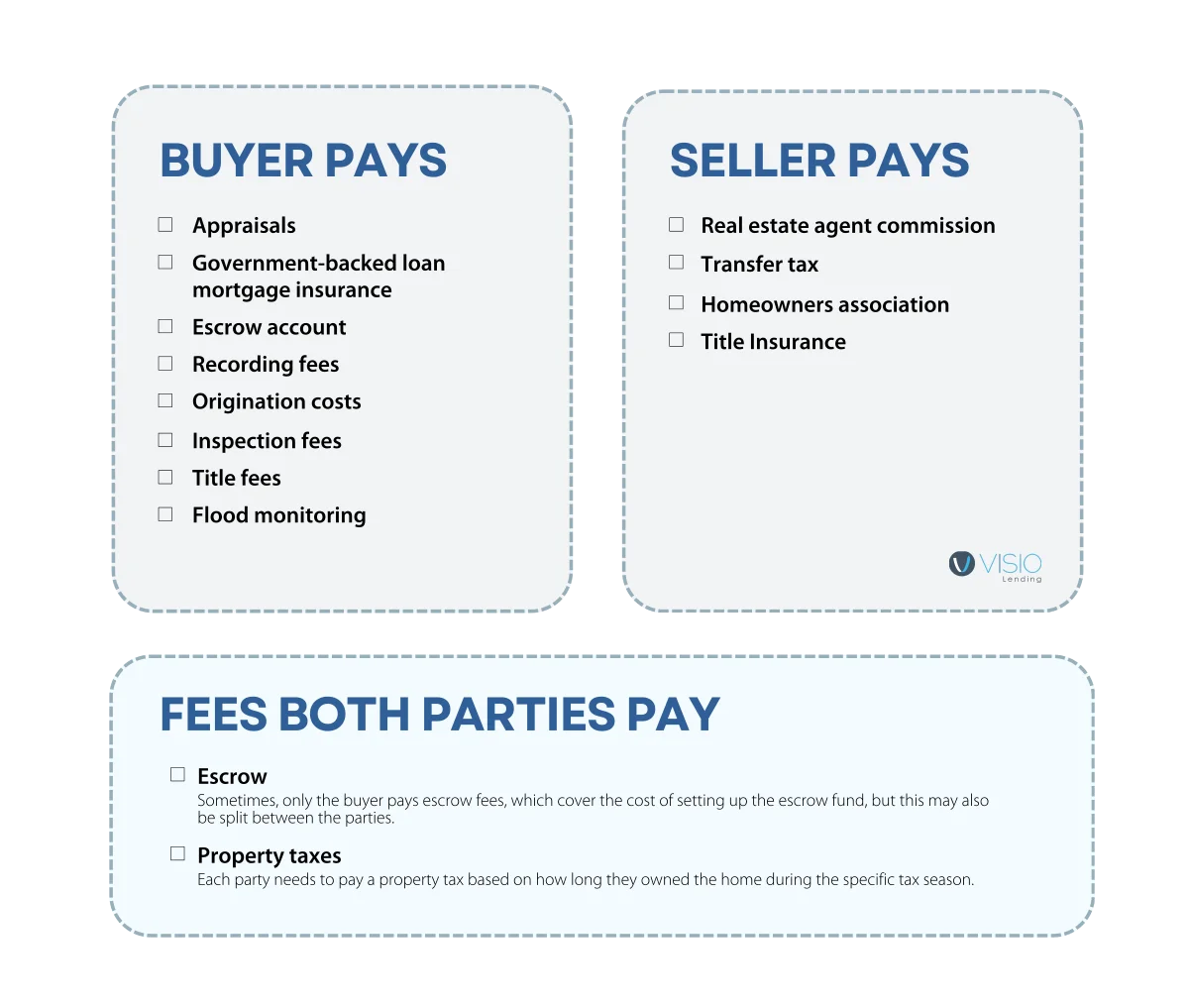

Both buyers and sellers must pay closing costs, though their percentages are split slightly differently. Buyers pay closing costs associated with their loan, while sellers pay closing costs associated with transferring the title and the realtor.

Buyer Closing Costs

The buyer’s closing costs are a bit higher, mostly because they typically work with a mortgage loan, and the lender has paperwork to complete to open the loan.

Typically, closing costs may amount to 6% of the final purchase price, though the average is usually lower.

Here are some of the most common closing costs and the average price the buyer pays.

- Appraisals – Lenders want to ensure the home is worth the cost before providing a loan estimate. The cost varies between $500 and $800.

- Government-backed loan mortgage insurance – For a conventional loan, you’ll have private mortgage insurance that’s paid monthly. In contrast, for a government-backed loan like an FHA loan, you will have an upfront mortgage insurance premium (UMIP) or a funding fee for a VA loan, which is a lump sum payment. These fees range from 1% to 3.3% of the total loan. After that, ongoing mortgage insurance premiums (MIP) will be part of your monthly mortgage costs.

- Escrow account – The lender will set up an account to pay property taxes, homeowners insurance, and, if necessary, insurance premiums for government loans. The escrow is usually two months’ worth of insurance and property taxes paid in advance.

- Recording fees – This pays the government to update property records and costs about $125.

Discount loan points – Paying interest on your mortgage can cost thousands over the life of your loan, so many buyers choose to reduce this burden by paying discount points as part of their closing costs. Each point is 1% of the total loan and will reduce your interest rate by a quarter. - Origination costs – Coming in at around 1% of the total loan amount, the origination fee covers the application fee, underwriting fee, and discount points if you choose to pay ahead to lower your interest rate.

- Inspection fees – In areas with termites, the lender may require a separate inspection for structural damage from pests. This is typically around $150.

Tax monitoring – This is for assessing property taxes and ensuring that they are correct. It usually costs about $150. - Title fees – You must also pay for a title search, the lender’s title insurance, and the owner’s title insurance. Sometimes, you will also pay title closing costs and attorney fees. Altogether, this comes to around 0.5% to 1% of the total loan.

- Flood monitoring – Lastly, you must pay for a flood risk assessment and identify whether the flood zone has changed. This is relatively inexpensive at just $50.

There’s a lot to pay at the closing table, but you can calculate closing costs ahead of time by talking to your lender and identifying exactly how much you should budget

Seller Closing Costs

The seller’s burden is a smaller percentage of the total closing costs. Still, they may actually pay more due to one significant element: the seller usually pays all commissions for both real estate agents.

This can bring their burden up to 10% of the total cost, though it varies widely based on the fee schedules of the real estate agents in their area.

Here are the typical costs for a seller and their average cost.

- Real estate agent commission – The seller often pays for both their own real estate agent and that of the buyer. Combined, these vary between 5% and 6% of the total home price.

- Transfer tax – Sellers pay for the cost of transferring the title from one party to another. This will vary by jurisdiction.

- Homeowners association – Not only do sellers have to pay the HOA fees for the time that they are in possession of the home, but they may need to pay fees to the HOA for transferring ownership. This varies by HOA.

- Title insurance – In some instances, the seller will pay for part of the owner’s and lender’s title insurance instead of the buyer’s. The percentage varies, but the seller may pay all of it, up to 1% of the purchase, or they may only pay a portion.

Fees Both Parties Pay

All closing costs, regardless of whether the buyer or seller is paying them, include:

- Escrow – Sometimes, only the buyer pays escrow fees, which cover the cost of setting up the escrow fund, but this may also be split between the parties.

- Property taxes – Each party needs to pay a property tax based on how long they owned the home during the specific tax season.

Again, this will vary by jurisdiction, so both parties will need to identify how much they need to pay in proportion to when the real estate transaction took place in the tax season.

Closing Costs Can Vary Depending on the Loan Type

In addition to learning who pays closing costs, you also must consider how closing costs vary based on loan type and amount.

Though some closing costs are a flat fee, such as appraisals and inspections, many are percentages of the total purchase, so they will be much higher if you are buying or selling a very expensive home.

With FHA loans, buyers need to pay UMIP, which is 1.75% of the loan amount. With VA loans, the funding fee can be up to 3.3%.

For the seller, agent commissions can vary across the country and even by the specific agent, so this can be a highly variable percentage. You’ll want to discuss this with the buyer and with the agents involved beforehand to get a better picture of what you’ll be paying.

Finally, every lender has different stipulations, which impact your burden. Some may want the first mortgage payment put in escrow, while others will not. You should discuss the lender’s expectations beforehand.

Both buyers and sellers can get a better idea of the average closing costs in their area by talking to others and asking their agent so that they’re prepared for the costs.

How to Save Money on Closing Costs

Fortunately, there are a number of ways that you can reduce your obligations. Closing costs are often highly negotiable, particularly if it is a buyer’s market or the seller is highly motivated to sell.

As a Seller

How much you can negotiate depends on the current market. If it’s a seller’s market, you may be able to offload some of your expenses onto the buyer, such as asking them to pay their own agent’s commission or covering all of the escrow opening fees.

As most of the seller’s closing costs come from real estate commissions, you can significantly cut your costs by foregoing a real estate agent. However, you will then miss out on the help that an agent can buy during negotiations over the purchase.

You may also be able to negotiate with both agents to reduce their commissions or shop around for an agent with a low commission percentage. This may mean that you have to put in a bit more work during the sale.

Finally, cash-only offers reduce your expenses because cash buyers often purchase a home as-is and do not work with realtors. Cash offers usually come from an investor rather than a residential buyer, but getting a cash offer from a residential homebuyer is also possible in some areas.

As a Buyer

Buyers want to reduce their upfront expenses as much as possible on a real estate deal, which is why many work with their mortgage lender to roll closing costs into their mortgage. This is called a no-closing-cost loan, but not all lenders provide this service.

If you’re worried that you won’t be able to afford closing costs, you should discuss this with your lender during the mortgage process. They may be able to credit some of the costs and ask you to pay higher interest.

While this means that your mortgage payments will be higher, it can also help you close on a property faster if the market is very hot.

You may also be able to ask for seller concessions, where the seller will contribute up to 6% of the total amount toward the sale’s expenses. This is more common in a buyer’s market, where you have more room to negotiate.

Sellers can sometimes be motivated to accept this because they can take it as a tax deduction, reducing their tax burden at the end of the year.

The Bottom Line

Closing costs are a significant expenditure, but the types of expenses paid by each party differ. A buyer’s closing costs are mostly related to their loan, while a seller’s closing costs are related to the transfer of the property and the sale itself.

If you’re ready to purchase your first rental property and begin developing passive income, contact Visio Lending to learn about our flexible, investment-friendly loan options.

What are the biggest closing costs usually paid by buyers?

Origination, paid to the lender, is the largest expense for the buyer and typically accounts for about 1% of the total sale price. If you buy a $120,000 home, you’ll have to pay $1,200 just for the origination.

What is the most the seller can pay in closing costs?

The most that a seller pays is 10%, which includes commissions for the agents involved in the sale. Without agents, this would be around 6% or less. It depends on the purchase agreement and market conditions.

What are the average closing costs in the US?

The average closing costs in the United States, including taxes, are about $6,905. Without taxes, this comes out to $3,860.

Can I avoid closing costs when buying a home?

Unfortunately, paying closing costs is something you cannot avoid when buying or selling a home. However, there are ways to reduce your burden, such as not working with agents and negotiating with the other party, asking them to take on more of the burden to complete the sale.