Skip the Guessing and Know Your DSCR in Seconds

Making informed decisions based on clear and accurate data is the foundation of a sound residential real estate investment strategy. Whether you're new to debt-service coverage ratio (DSCR) loans or a seasoned investor, our DSCR calculator helps you evaluate the financial viability of your investment property.

Because this information is critical to you, we've created a comprehensive resource, which includes an interactive DSCR calculator, a detailed breakdown of how to calculate and interpret DSCR, common mistakes to avoid and much more.

Now, it's time to turn data into action. Play around with the calculator and explore the guide to take the next step in building or growing your portfolio.

Table of Contents

Understanding DSCR and Its Importance

DSCR is a financial metric used by real estate investors and lenders to assess the ability of an investment property to generate enough income to cover its debt obligations. Specifically, DSCR measures the ratio of a property's monthly rental income to its total debt service, which includes monthly principal, interest payments, taxes, insurance and association dues (PITIA).

For real estate investors, DSCR is a key indicator of a property's financial health. A high DSCR suggests that the property generates more than enough income to cover its debt payments, reducing the risk of default.

On the contrary, a low DSCR may indicate that the property doesn’t generate a sufficient monthly payment, leading to financial difficulties and making it more challenging to secure financing.

Lenders also rely heavily on DSCR when evaluating loan applications. A strong DSCR reassures lenders that the borrower will be able to meet their debt obligations, making them more likely to approve the loan. On the other hand, a weak DSCR may result in higher interest rates, stricter loan terms, or even loan denial.

What is a DSCR Calculator

A DSCR calculator is an interactive financial tool designed to help you quickly and accurately determine a property's DSCR. By inputting your property's specific information, the calculator will provide you with a DSCR in seconds. You can use this information to assess if pursuing a DSCR loan on the property is worth it.

Our DSCR calculator offers several benefits, including the ability to quickly evaluate a rental property's potential and seamlessly compare multiple investment opportunities. Additionally, it provides a clear and standardized method for estimating the likelihood of securing financing.

Step-by-Step Process for DCSR Calculation

Although you can calculate a property's DSCR manually, many investors prefer our interactive tool for its ease of use and the ability to get accurate results in seconds. Here is a step-by-step breakdown of how to calculate DSCR using our tool.

Gather financial data

Before you can start playing around with the calculator, you'll need to collect the necessary financial information for the property, including monthly rental income and total debt obligations. Ensuring the data is accurate and up-to-date is important, as errors can significantly affect the DSCR calculation.

Determine monthly rental income

Use tools like Rentometer to compare market rents and estimate a property's potential monthly rental income. Checking local listings, consulting property managers or reviewing lease agreements can provide additional insights. A precise estimate ensures a realistic DSCR calculation and accurate cash flow assessment.

Calculate total debt-service

Principal, interest, taxes, insurance, and association dues (PITIA) are all factors that fall under debt obligations when calculating DSCR. Here's how to obtain the proper details on a prospective rental property.

- Monthly principal and interest payment: Determine the total loan amount by subtracting the down payment from the property's purchase price. Once you have that, you'll need to determine the interest rate and identify the term. You can use a standard mortgage calculator to get an accurate monthly principal and interest payment

- Monthly taxes: To get an estimate of monthly taxes on a prospective property, contact the local tax assessor’s office, check the county’s property tax records online or review recent tax bills for the property

- Monthly insurance: Lenders may require extensive coverage depending on the property's location. Contact insurance providers to get a quote and a potential monthly payment

- Monthly association dues: Check the property's listing for a mention of HOA and the potential dues. If dues are not listed, consider contacting the seller or agent

Use the DSCR calculator

Input the property's monthly rental income and each individual debt obligation into the calculator. The calculator will instantaneously process the data and generate the DSCR.

Analyze the results

Evaluate the DSCR in the context of your investment goals. Consider how different variables, such as changes in rent or interest rates, might affect the DSCR and, consequently, the property's financial stability.

DSCR Scores Explained

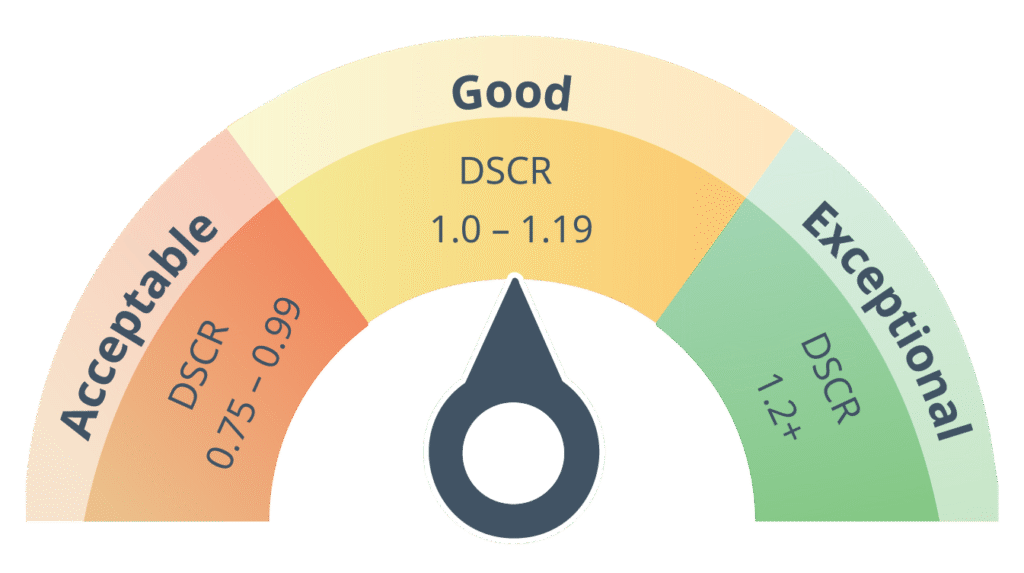

Lenders use DSCR scores to assess risk and determine loan eligibility. Viso categorizes scores into three tiers: Exceptional, Good and Acceptable. Here’s a closer look at what each designation means.

Exceptional (1.2+)

A DSCR of 1.2 or higher is generally considered a positive indicator. This means the property generates 20% more income than necessary to cover its debt, providing a buffer for unexpected expenses. Properties with an exceptional DSCR are more likely to secure favorable financing terms, such as lower interest rates and loan amounts.

Good (1.0 - 1.19)

A DSCR between 1.0 and 1.19 signifies that the property generates just enough income to cover its debt obligations with a slight margin for error. Although considered good, lenders may require additional assurances, such as higher down payments or stricter loan terms.

Acceptable (0.75 - 0.99)

A DSCR between 0.75 and 0.99 is considered acceptable by various lenders, but it does raise a red flag. It indicates that the property may struggle to meet its debt obligations, resulting in the risk of defaulting on the loan. Properties with an acceptable DSCR may face higher interest rates, lower loan amounts or outright denial.

Different scenarios can lead to varying DSCR outcomes, and investors need to consider these when evaluating potential investments. For instance, a property in an idyllic location, with a DSCR of 1.15, may still be a viable investment if rental income is expected to rise. Conversely, a property in a declining market with a DSCR of 1.25 might carry more risk than expected.

Why DSCR Matters for Investors and Lenders

From both an investor's and a lender's perspective, DSCR strongly influences financing decisions, investment strategies and long-term financial planning.

For investors, a strong DSCR improves the likelihood of securing financing at favorable terms, which can enhance the profitability of the investment. It also provides a safety net against unforeseen expenses, such as repairs or vacancies, reducing the risk of default. Investors can use DSCR to compare properties, assess risk and make informed decisions aligning with their financial goals.

On the other hand, lenders rely on DSCR to evaluate the risk associated with a loan. A high DSCR reassures lenders that borrowers will likely meet their debt obligations, leading to more favorable loan terms. Conversely, a low DSCR signals higher risk, prompting lenders to adjust loan terms or deny the loan altogether. By assessing DSCR, lenders can better manage their risk exposure and ensure that loans are extended to creditworthy borrowers.

DSCR also plays a role in long-term investment planning and risk management. Investors with a clear understanding of DSCR can better anticipate potential challenges, such as market conditions or interest rates, and adjust their strategies accordingly.

Common Mistakes to Avoid When Using a DSCR Calculator

While DSCR calculators are valuable tools, they're only as effective as the data inputted and the user's understanding of the metric. Here are some common mistakes to avoid:

Inaccurate Data Input

One of the most common errors is inputting incorrect financial data, such as overstating income or expenses. This can lead to misleading DSCR results and poor investment decisions. Always double-check your data for accuracy.

Ignoring Future Projections

Focusing solely on the current monthly payment and expenses without considering future projections can be risky. Market conditions, rent and interest rates can change, affecting the property’s DSCR. Consider how these variables might impact the property over a prolonged period.

Overreliance on DSCR

While DSCR is an important metric, it should not be the sole factor in making investment decisions. Investors should consider other financial metrics, such as loan-to-value (LTV) ratio, capitalization rate and cash flow, to comprehensively understand the property’s economic viability.

Start Your DSCR Loan Process

Understanding your DSCR and where you might stand on eligibility is just the beginning. Now, it's time to turn your DSCR results into action. With a straightforward application process and flexible, investor-focused loan options, you’re ready to secure the financing you need to grow your investment portfolio.