Focused on DSCR. Driven by Results. Trusted by Thousands of Investors Nationwide.

Grow Your Rental Portfolio Faster with the Visio Advantage

Leverage your rental income to qualify for investment properties with Visio Lending’s DSCR loan. Experience fast, flexible and reliable financing needed to scale your portfolio.

Let us help you plan for your next Investment Property

Talk to a DSCR Expert

How it Works

HOW DO DSCR LOANS WORK?

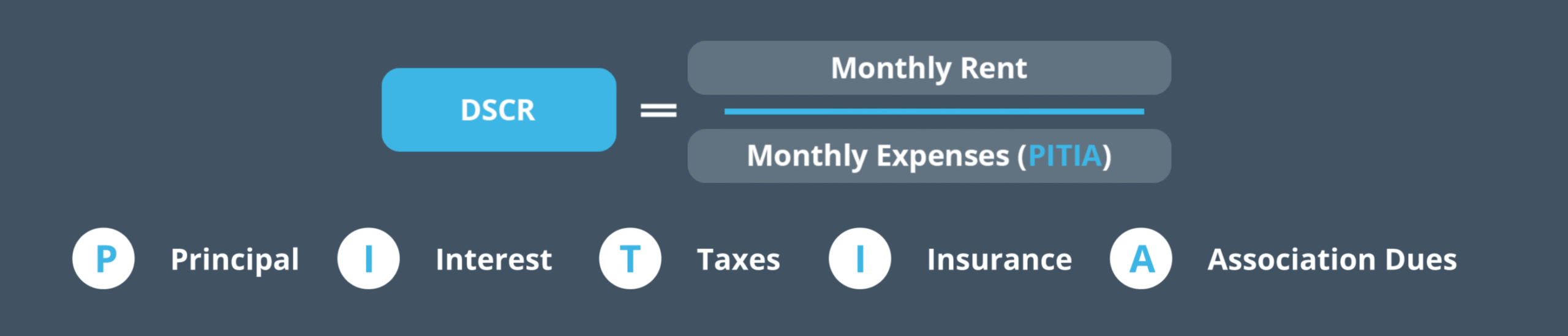

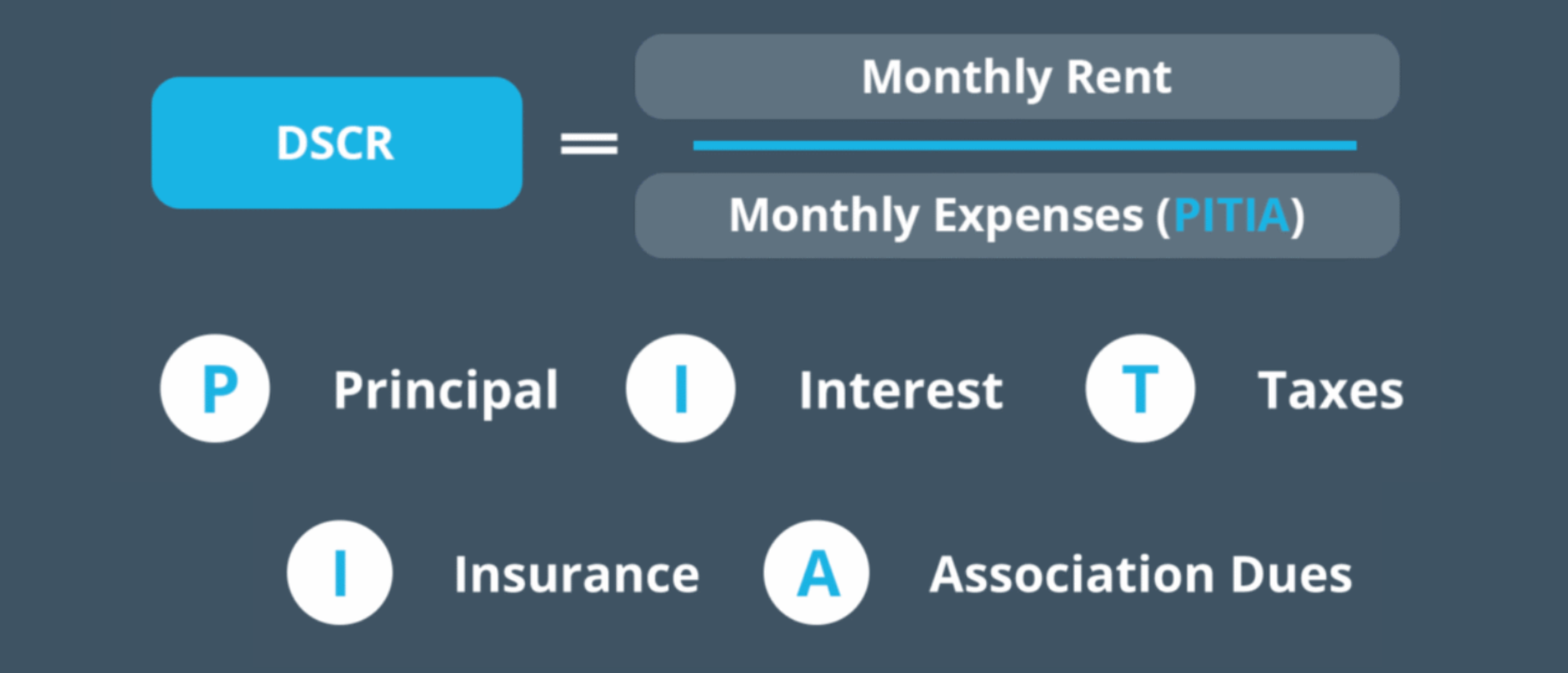

DSCR is a metric that helps lenders understand a borrower’s ability to pay back a loan based on the property’s monthly rental income. It’s a simplified way to measure cash flow. To calculate the DSCR, you divide the monthly rent by the monthly principal, interest payments, taxes, insurance and association dues (PITIA).

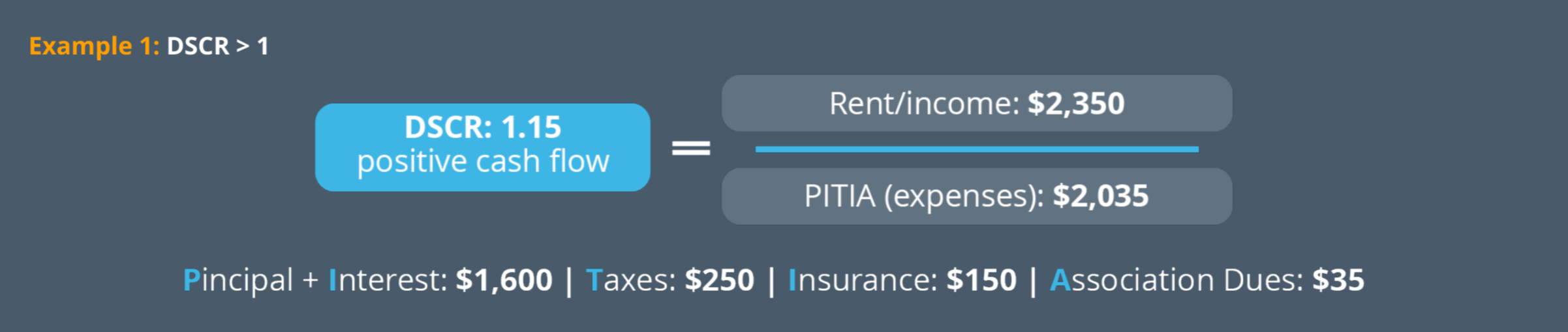

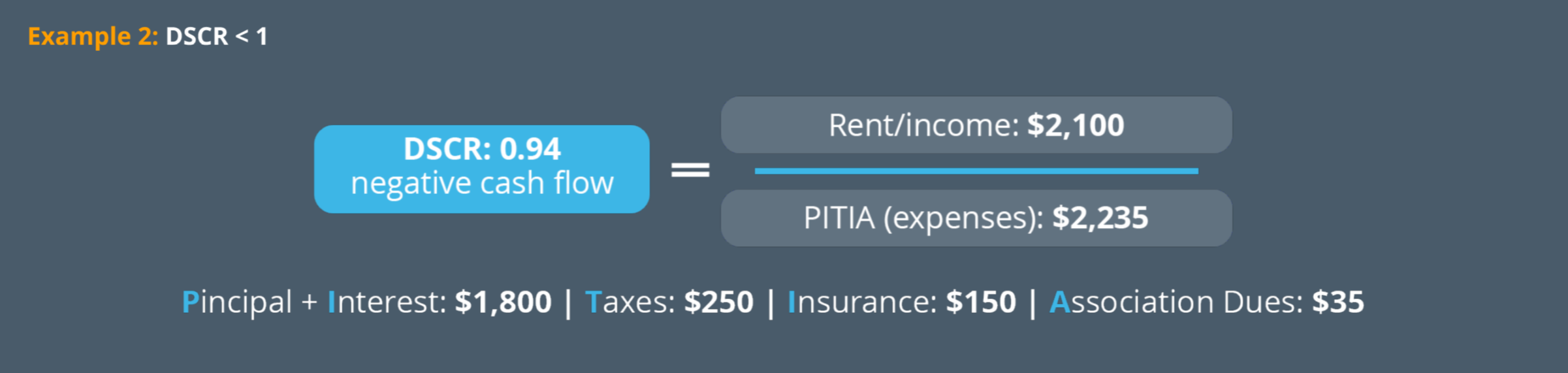

A DSCR of one indicates that the property’s income equals its expenses, meaning you’re breaking even. A DSCR of less than one signifies that the investor would need to subsidize the rest of the money with income from other sources.

Investors should target a minimum DSCR of 1.2, while 1.5 or higher is considered excellent. With DSCR, the rule is simple—the higher, the better.

Here are some examples to see how the DSCR calculation works:

If you are an investor who’s looking to obtain a DSCR mortgage, make sure you meet these basic requirements:

- Minimum credit score: Most DSCR lenders require a 680 credit score, with better rates for higher credit. Most lenders also have minimum tradeline requirements, including both amount and duration. Lenders will also consider whether you have any other significant credit events on your credit report, such as foreclosures, bankruptcies or past-due payments

- Minimum down payment or equity: Down payment requirements may vary, but you can expect between 20% and 30% of the property’s purchase price

- Minimum property value: Most lenders have a minimum property value of $150,000

- Minimum loan amount: A good minimum standard is $75,000

What is it?

What is a Debt-Service Ratio (DSCR) Loan?

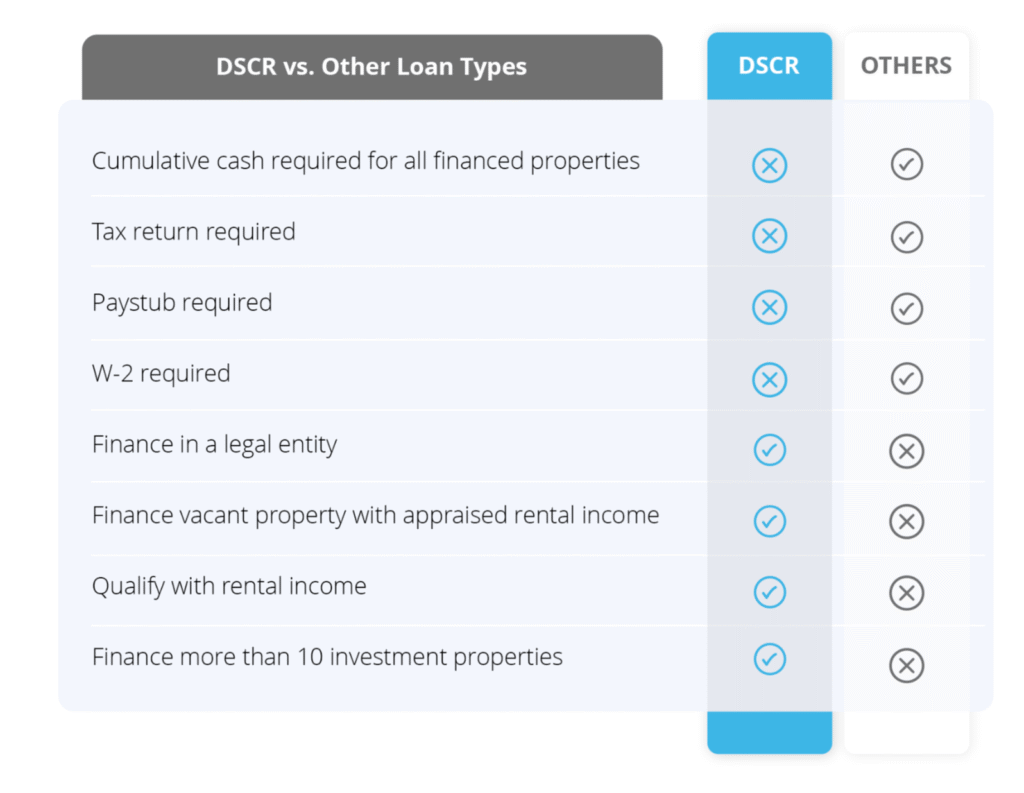

A debt-service coverage ratio (DSCR) loan helps investors obtain financing without the strict requirements of a traditional mortgage. While other mortgage types use personal income to determine a debt-to-income ratio (DTI) for eligibility, a DSCR loan leverages the property’s performance as an asset. DSCR loans are the perfect option for all real estate investors, especially those with a variable income.

How Do I Apply for a DSCR loan?

Visio leverages more than a decade of experience to provide you with the smoothest loan application process possible. From the initial application to closing, we support investors every step of the way. Here's an overview of our simplified application process.

During the application process, Visio will collect the necessary documentation to determine eligibility and expected financing terms. Since a property appraisal is required to confirm rental market value and ensure DSCR thresholds are met, we’ll order the appraisal at this time.

- Application

- Credit pull

- Borrower’s authorization

- Order appraisal

- Primary ID

- Purchase contract

Visio works with the borrower and third-party entities to compile a complete loan file to verify eligibility and terms.

- Background check

- Title and property tax certificate

- Insurance (Flood and unnamed perils)

- Entity documents

- Reserves

Visio approves your loan and coordinates closing and funding with an approved title company.

- Funding process

- Closing and signature requirements

The borrower submits their monthly loan and escrow payments to a loan servicer for payment collection and accounting.

Testimonials

Zachary Cohen

Gautam Tulsian

Visio Lending is the Best for DSCR Loans!

When it comes to DSCR loans, Visio Lending is simply the best. I’ve had the privilege of working closely with Tracy, who is an outstanding loan officer. Tracy’s combination of excellent rates, unmatched service, and unwavering attentiveness makes every transaction a smooth and successful experience.

I absolutely love working with Visio Lending and highly recommend them to anyone in need of a lender that prioritizes client success. They truly stand out in the industry!

Jordan Ebelini

David Schulwitz

Jaisheel Prakash

My AE Matthew M. Priester attended and helped us in all process to turn in a smooth transaction. Visio has organized fast process. I used only DSCR program and it's very competitive with the market. Very recommended.

Orlando D.