For generations, the American Dream has been defined by the idea of owning a home, which represented a sense of stability, achievement and financial freedom. But for millions of Americans, that milestone now feels more like a pipe dream than an attainable goal. With home prices climbing and mortgage rates remaining elevated, a significant portion of the population is choosing to rent rather than buy. A recent analysis by Bankrate shows that across the 50 largest U.S. metro regions, renting is generally more affordable than owning a home in 2025.

This shift has paved the way for one of the fastest-growing trends in residential real estate: built-to-rent (BTR) properties. Once a niche concept, BTR now accounts for 8.4% of all single-family housing starts as of Q1 2025, according to Arbor Realty Trust. For investors focused on long-term cash flow and property appreciation, BTR offers opportunities to capitalize on rising rental demand, scale projects efficiently and generate sustainable returns.

Successfully deploying a BTR strategy requires more than identifying the right community. A thoughtful financing approach is crucial, starting with short-term construction or bridge funding and transitioning into a DSCR refinance, similar in concept to the BRRRR method.

If you’re considering BTR as part of your investment strategy, keep reading to learn the ins and outs of built-to-rent, why having a strategic financing plan matters and how the two-step approach can help build long-term success.

What Is Built-to-Rent (BTR)?

Built-to-rent (BTR) refers to residential properties that are specifically designed and constructed for the purpose of being rented, rather than sold to homebuyers. BTRs generally fall under one of the following property types:

- Detached single-family residences

- Townhomes

- Condos

- Vacation rentals

There are two primary approaches to a BTR investment strategy. The first is BTR communities, where an entire neighborhood of rental homes is built and managed by a single entity, such as a developer or property management company. These communities are often operated like luxury apartment complexes, featuring amenities such as leasing offices, pools and fitness centers. The second is individual BTR projects, where an investor purchases land and partners with a builder to construct one or more rental properties.

Ultimately, deciding between a BTR community and an individual project depends on your investment goals, desired level of involvement and risk tolerance, but financing is where the strategy truly takes shape. Investors who plan their funding approach early are best positioned to capture long-term cash flow and appreciation.

Why Financing Strategy Matters in BTR

Success in BTR goes beyond simply choosing the right market. Even with strong rental demand, it’s the financing strategy that ultimately determines whether a project achieves a positive result.

Much like the BRRRR method, built-to-rent financing requires a phased approach across different stages of the project. Investors typically begin with short-term financing to get the property off the ground, then transition into a long-term solution that covers ongoing operating costs and turns the property into an income-producing asset.

That’s why a two-step approach has become the preferred method for a BTR strategy. By planning ahead for both phases of financing, you can move seamlessly from development to a fully operational property.

Understanding the Two-Step Financing Approach for BTR

The two-step financing approach splits a BTR project into construction and refinance phases, giving each stage the funding and planning it requires. This structure helps you manage risk, stabilize cash flow and sets the foundation for success. Let’s take a closer look at each step.

Step one: Short-term construction or bridge financing

The first step in turning a BTR project from concept to reality is securing the capital to get it off the ground. This phase should provide enough funding to cover construction costs, land acquisition, permits and other upfront expenses necessary to bring the property to life.

There are several short-term financing options to explore for your BTR project:

- Construction loan: This short-term option is ideal for a BTR strategy, as it’s specifically designed to cover initial development costs. Construction loans often come with interest-only payments to ease financial pressure during the building phase

- Bridge loan: BTR investors like this option for its flexibility, providing temporary financing that bridges the gap between land acquisition and long-term funding

- Hard money loan: This asset-based option gives investors fast access to capital for the initial construction phase, before transitioning to a long-term investment property loan

Once construction is complete and development costs are covered, the focus moves to the second phase: refinancing into a DSCR loan to secure consistent cash flow and position the property for long-term success.

Step two: Refinancing into a DSCR loan

With your built-to-rent community or individual project complete, the next phase is to refinance your short-term loan into a long-term DSCR loan, creating stable cash flow and positioning the property for lasting success.

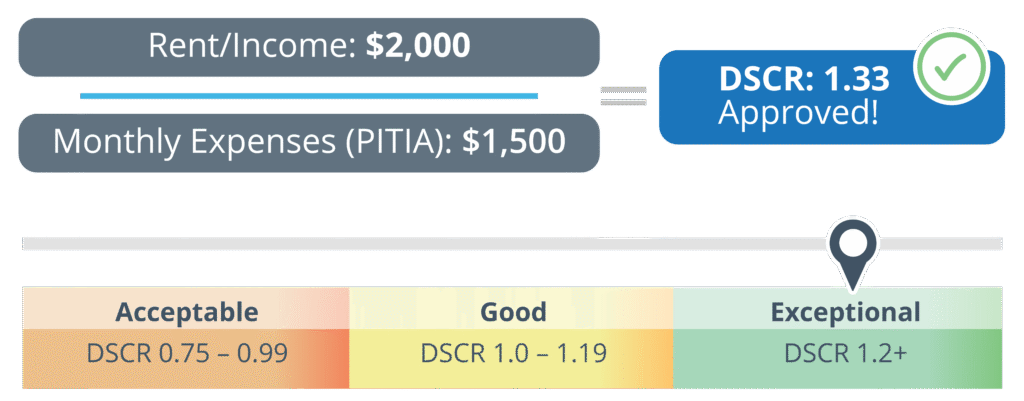

A DSCR loan is a type of investment property loan that qualifies you based on the property’s income potential instead of your personal finances. Your DSCR is calculated by dividing the property’s monthly rental income by its monthly expenses, including principal, interest, taxes, insurance and any association dues (PITIA).

For example, if your monthly rental income is $2,000 and your total debt service is $1,500, your DSCR would be 1.33. Lenders generally view a ratio above 1.2 as “exceptional,” often qualifying you for more favorable rates and terms. In this case, a 1.33 DSCR means the property generates 33% more income than its debt obligations.

The two-step built-to-rent financing model works because the DSCR refinance turns your project from a development phase into a dependable cash-flowing asset. This transition not only strengthens your property’s performance but also frees up capital for additional BTR projects or diversifying your investments.

Why DSCR Loans Are the Ideal Choice for BTR

In the refinance phase, the loan you choose will determine how efficiently your built-to-rent project transitions into long-term success. DSCR loans are a favorite among investors because they’re designed around rental income, making it easier to establish consistent cash flow from a single property or scale an entire community.

BTR investors also value the flexibility DSCR loans offer, giving them the freedom to choose the rental strategy that best fits their market. Instead of being restricted to a specific model, DSCR financing allows you to shift between a short-term rental and a long-term rental approach while still meeting loan requirements.

Beyond the flexibility aspect, DSCR loans have requirements that can work in your favor as a built-to-rent investor. Here’s a closer look at how they support long-term BTR success:

- Property types: Single-family residential, vacation rentals, condos and townhomes

- Maximum loan-to-value (LTV): 80% for rate-and-term refinances and 75% for cash-out refinances

- Minimum Credit Score: 680

- Minimum Property Value: $150,000

- Vacancy-friendly: No rate or LTV adjustments for vacant properties; leasing not required. Ideal for BTR investors because it allows new developments or communities to stabilize without penalty while units are being filled

- 30-day seasoning for refinances: Property must be owned for at least 30 days before refinancing. Perfect for BTR investors, giving new projects a short window to prepare for long-term financing without delaying the refinance process

Your Roadmap to BTR Success

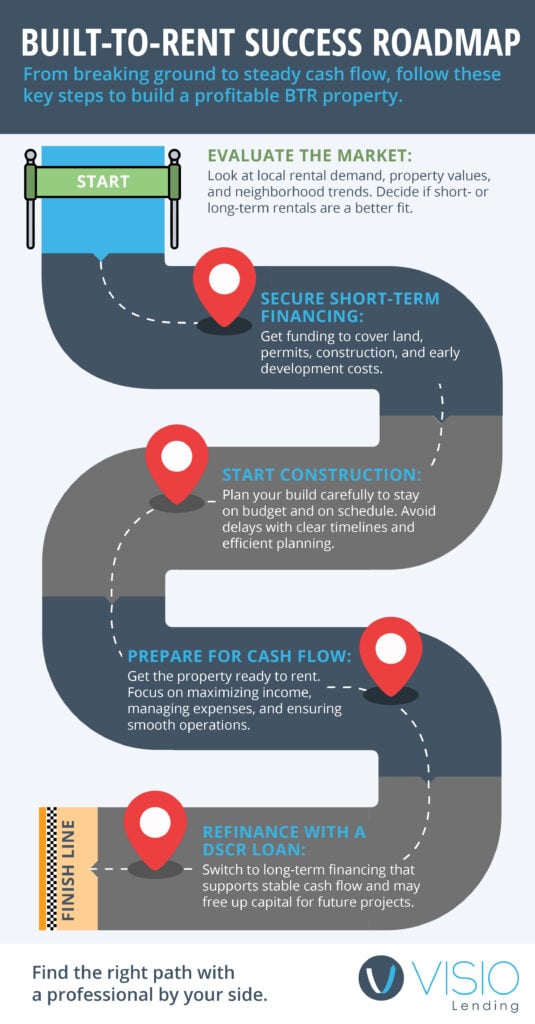

Successfully completing a built-to-rent investment isn’t something you can leave to chance. From securing short-term financing and breaking ground on development to refinancing into a DSCR loan, there are many moving parts that require a clear, intentional approach. While every BTR project is unique, the following steps provide a roadmap to help you move from construction to a stable cash-flowing rental property.

- Evaluate the market opportunity: Assess local rental demand, property values and neighborhood trends. Decide whether a short- or long-term rental strategy fits this market best

- Obtain short-term financing: Secure the necessary funds to launch your BTR project, covering early expenses like land, construction, permits and any other costs needed for development

- Break ground on development: Create comprehensive construction plans that prioritize timelines, efficiency and budget to avoid costly delays

- Position for cash flow: Set up the property to deliver consistent income from day one by preparing for occupancy, managing debt obligations and optimizing rental performance

- Refinance into a DSCR loan: Transition from short-term funding to a long-term DSCR loan to position the property for consistent cash flow and potentially free up capital for future investments

From Build to Refinance: Visio Makes BTR Financing Simple

While built-to-rent isn’t a new concept, it’s a trend that shows no signs of slowing down, especially as homeownership remains out of reach for millions of Americans. For investors, BTR is another tool in the toolbox, alongside BRRRR, fix-and-flip and short- or long-term rentals.

Whether you’re considering a single property or an entire BTR community, having a clear financing plan is essential. Leveraging the two-step approach, starting with short-term construction or bridge funding and transitioning into a DSCR refinance, can turn your project from a development phase into a scalable, cash-flowing investment.

That’s why it’s never too early to start thinking about the refinance phase. Partnering with Visio Lending lets you align your financing approach with your investment goals from day one. As the nation’s No. 1 DSCR lender, Visio understands the nuances of transitioning from short- to long-term investment property funding.