Selling your home might feel like closing one chapter and opening another. But if you’re moving on, whether because you’ve outgrown your starter home or your life is taking you somewhere new, holding onto that property could be a strategic financial move.

Converting your primary residence into a rental property can be a great way to generate additional income, and it may be the perfect starting point for growing an investment property business. After all, what better place to begin than with a property you already know inside and out?

However, turning your home into a rental isn’t as simple as listing it and finding tenants. To set yourself up for success, you’ll need a plan that accounts for your current mortgage, tax implications and the logistics of making the switch.

In the sections ahead, we’ll explore the benefits of converting your primary home to a rental and walk through the steps for a smooth transition. We’ll also explain how a DSCR loan can support your strategy, including what it takes for your property to qualify.

Why Convert a Primary Residence into a Rental Property?

Converting your primary residence into a rental property goes beyond just earning extra income. It also offers a low-risk way to enter real estate investing. With lower initial costs and fewer uncertainties, it’s often a smarter choice than selling the property outright.

Here are a few more advantages to holding onto your home and turning it into a rental:

- Tax advantages: Rental properties typically qualify for extra deductions on mortgage interest, depreciation, repairs and maintenance. As a result, you can help lower your taxable income

- Appreciation potential: Holding onto your property longer gives it time to grow in value. In appreciating markets, that can mean increased equity and long-term gains

- Steady cash flow: A well-maintained and well-located property can generate consistent monthly income, helping to cover your expenses or save for future investments

- Diversified income stream: Adding rental income creates more financial stability and can help create a buffer against unexpected changes in your primary income

- Lower barrier to entry: Since you already own the home, there’s no need for a new down payment or competing with others to purchase the property

- Familiar asset: You know the property’s condition and the neighborhood firsthand, making it easier to manage, maintain and market to tenants

Before You Decide: Consult With a CPA or Legal Professional

Converting your primary residence into a rental comes with various tax and legal implications. Talk to a licensed CPA or real estate attorney to avoid surprises or delays in the process.

What Makes a Property DSCR-Eligible?

Moving from personal use to rental use opens up new financing opportunities. But it also changes how lenders evaluate your property. Instead of viewing it as a residence, they now see it as a business asset, and that means a different type of loan with a distinct set of requirements.

While there are various financing options out there for rental properties, DSCR loans have recently become a popular option for real estate investors. That’s because borrowers qualify based on the property’s rental income, not their personal income.

Not sure if your property qualifies for a DSCR loan? Here’s a quick checklist:

- Property type: Must be a 1-4-unit residential property

- Occupancy: Must be non-owner-occupied. Once the transition is complete, you shouldn’t be living in the property, and it should function strictly as a short-term rental or long-term rental.

- Rental income coverage: The monthly rental income generated should cover the monthly debt service

- Condition: The home must be rent-ready and in C4 condition or better, meaning it must be fully functional, structurally sound, clean and well-maintained

From Primary Residence to DSCR Rental: How the Process Works

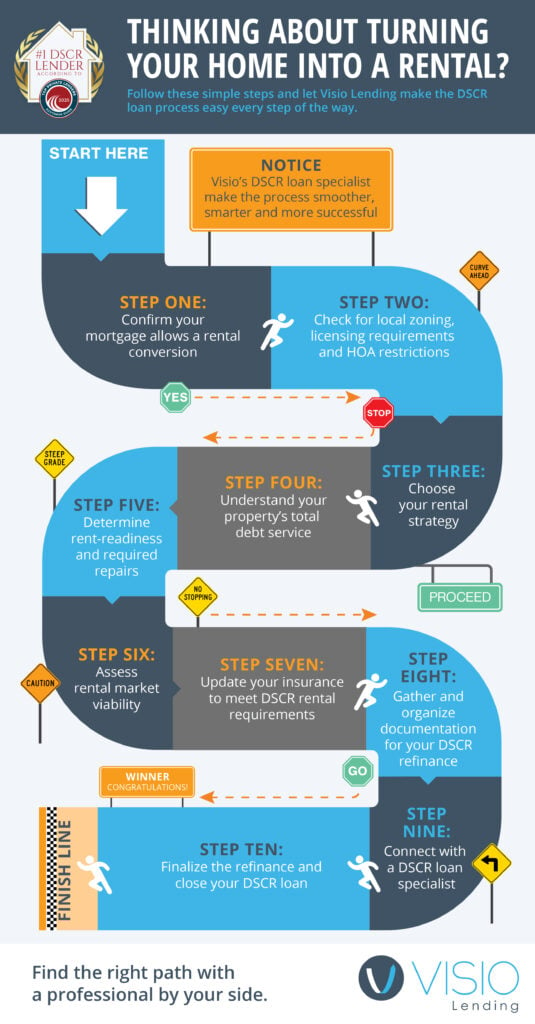

Turning your primary residence into a rental property isn’t something you can figure out along the way. With so many moving parts, it requires thoughtful planning and a clear strategy. While every situation is unique, the following steps can help guide your transition from an owner-occupied home to a DSCR-eligible rental.

Step one: Confirm your mortgage allows a rental conversion

Before converting your primary residence into a rental, be sure to contact your lender. Most mortgages, including conventional, FHA and VA loans, have occupancy clauses that require you to live in the home for a certain period. While the specific time frame generally varies by lender and mortgage type, the standard occupancy requirements typically state that the borrower must occupy the property as their primary residence for at least one full year after closing.

Additionally, because the original mortgage was based on your intent to live in the home, your lender may require you to refinance into a loan designed for rentals, like a DSCR loan.

Taking care of this step early can help you avoid costly mistakes or delays down the line.

Step two: Check for local zoning, licensing requirements and HOA restrictions

After confirming your financing options with your lender, it’s just as important to make sure your property is legally eligible to be used as a rental. That includes checking local zoning laws, rental licensing requirements and any HOA restrictions. It may not be the most exciting step, but it’s essential to ensure your plan is viable from the start.

These regulations can vary widely by location. Some cities require homeowners to register their property as a rental, obtain a permit and meet specific occupancy or safety standards.

For example, in Los Angeles County, landlords must register rental properties and pay an annual fee. On the other hand, a city like Houston generally doesn’t require rental registration unless you’re operating a short-term rental.

That distinction is important because many cities and HOAs have introduced separate laws and guidelines for short-term rentals. If you’re considering that route, be sure your area allows STRs and the property complies with specific guidelines outlined by your HOA, if applicable.

Step three: Choose your rental strategy

Your rental strategy sets the foundation for all subsequent decisions. Whether you choose a short- or long-term approach, this choice affects permits, insurance, tenant management and cash flow expectations.

While your rental strategy is ultimately your decision, you’ll want to tailor it to your property’s location, local regulations, demand, risk tolerance and any other relevant factors to position yourself for success.

Short-term rental strategies often involve:

- Navigation and compliance with stricter local regulations and HOA rules

- More active tenant management and turnover

- Higher potential cash flow, but also more variable income

- Awareness that cash flow can be unpredictable due to fluctuating demand and higher operating costs

Long-term rental strategies typically involve:

- Stable, consistent tenant occupancy

- Less frequent tenant turnover and management

- Potentially lower monthly income but steadier cash flow

- Lower operating costs and minimal day-to-day management

Step four: Understand your property’s total debt service

When lenders refer to debt service, they’re talking about the total monthly expenses required to operate the property. In a DSCR loan, your eligibility is mainly based on how well the rental income covers those expenses.

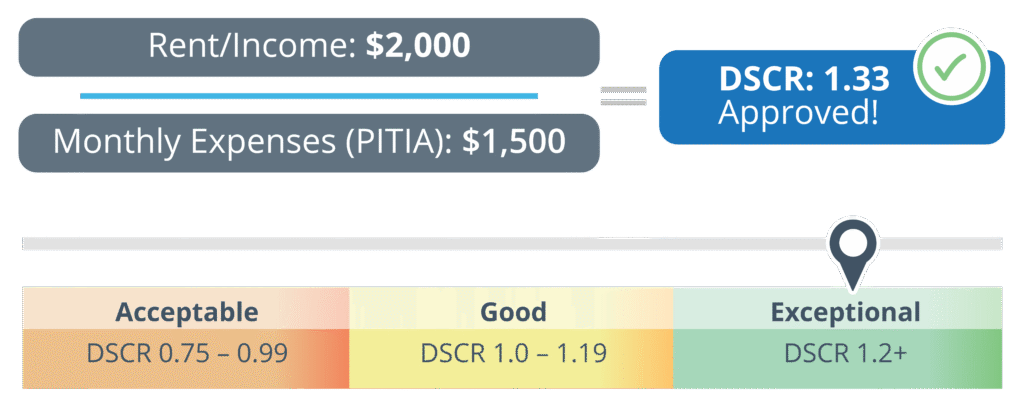

DSCR is calculated by dividing the property’s monthly rental income by its monthly operating costs, including principal, interest, taxes, insurance and any applicable association dues (PITIA).

Many investors strive for a minimum DSCR of 1.2. Here is a breakdown of the score ranges and what they mean:

- Exceptional (1.2+): The property generates at least 20% more income than expenses. Often qualifies for more favorable rates and terms

- Good (1.0–1.19): Covers expenses with a small cushion. May need a higher down payment or stricter terms

- Acceptable (0.75–0.99): Rental income falls slightly short of full coverage. Financing may still be possible, but with higher rates or reduced loan amounts

In the example above, the investor earns $2,000 in monthly rental income and has $1,500 in monthly debt obligations. That results in a DSCR of 1.33, which falls into the “Exceptional” category.

Step five: Determine rent-readiness and required repairs

As mentioned earlier, your property must be in C4 condition or better to qualify for a DSCR loan. This means it should be clean, functional and free of major issues that could impact safety or marketability. To prevent delays during the appraisal, it’s a good idea to assess the home in advance and identify any repairs or upgrades that might be needed.

Here are a few areas to pay attention to:

- Appliances: Ensure they’re in working condition or consider replacing outdated units

- Interior surfaces: Freshen up walls with paint and address any visible wear or damage

- Safety concerns: Remove hazards like exposed wiring or loose railings

- Flooring: Replace torn carpets or heavily worn areas that detract from the property’s appeal

Step six: Assess rental market viability

Like any smart investment decision, it all starts with data. No matter which rental strategy you’re considering, it’s important to evaluate whether your property is positioned to perform as a rental. Just keep in mind that rental viability looks different depending on whether you’re pursuing a short- or long-term approach.

And while it might be tempting to pick a strategy based on personal preference, like wanting to run a vacation rental, it’s more effective to let the market guide your decision. When converting your primary residence into a rental, steps three and six go hand in hand. Your strategy should align with what your market can realistically support.

Step seven: Update your insurance to meet DSCR rental requirements

Many homeowners who convert their primary residence into a DSCR rental overlook the need to update their insurance policy. Unfortunately, standard homeowners insurance typically doesn’t provide the right coverage for rental properties.

While insurance requirements vary by lender, Visio Lending requires the following coverages for a DSCR loan:

- Policy type: Standard homeowners insurance (e.g., HO-1) is not sufficient. Coverage must be appropriate for rental properties and landlords

- Required coverage: Must include a standard extended coverage endorsement that protects against loss and hazards typical for the property’s location

- Coverage amount: Must equal 100% of the insurable value or the loan amount, whichever is greater, and must fully cover replacement costs

- Recommended policy: A Dwelling Property 3 (DP3) policy or similar is typically acceptable

- Additional coverage: Flood insurance is required if the property is located in a designated flood zone. Depending on location, coverage for other perils, such as wind or earthquakes, may also be required

Step eight: Gather and organize documentation for your DSCR refinance

When you connect with a DSCR loan specialist, they’ll walk you through the documentation required to complete your refinance. To help simplify the process and avoid unnecessary delays, here’s a list of documents you may be asked to provide during the application process:

- One form of ID for each guarantor

- Voided check

- Insurance declaration page

- Lender’s title insurance policy

- Business entity documents (if borrowing through a company)

- HOA contact information (if applicable)

- Current lender details (for cash-out refinances)

Step nine: Connect with a DSCR loan specialist

While this step appears near the end, it’s one you’ll want to prioritize early. Once you’ve confirmed your mortgage allows for a rental conversion and your property is DSCR-eligible, connecting with a DSCR loan specialist can help you align your financing strategy from the start.

Because DSCR loans are still relatively new to the residential real estate space, many lenders treat them as a niche offering rather than a core service. A lender like Visio, which solely focuses on investment property loans, can provide the experience you need from the start.

Getting specialized insight early in the process can help you avoid costly mistakes, clarify documentation requirements and stay ahead of potential delays.

Step ten: Finalize the refinance and close your DSCR loan

You’ve done the planning, secured the necessary permits and licenses, and made sure the property is ready for tenants. With everything in place, the only thing left is to complete the refinance and transition your mortgage from a primary residence to an investment property loan.

To keep your closing on track, it helps to know what to expect. While the exact process can vary by lender, at Visio, we’ve simplified it into four steps to make the finish line easier to reach.

Here’s an overview of Visio’s loan process:

- Apply and submit documents: You’ll fill out a simple online application and provide ID, credit authorization and preliminary property details

- Complete the loan file: We order an appraisal, pull credit, verify insurance, and ensure your property and entity documents are in order

- Approval and closing: Once underwritten, your loan is approved. Visio coordinates with a title company to finalize closing and transfer funds

- Begin payments: You make monthly principal and interest payments through a servicer, officially launching your rental business

Converting a Primary Residence into a Rental Property: FAQS

How long do I need to live in my primary residence before converting it to a rental property?

While the specific seasoning requirement may vary by lender, most lenders require you to live in the property for at least a year before refinancing it into a rental. For the most accurate information, check your mortgage terms or verify with your current lender to ensure proper compliance.

What insurance do I need when converting to a rental property?

Most standard homeowners’ insurance policies don’t provide adequate coverage for landlords. When shopping for insurance policies, make sure that you’re covered under a standard extended coverage endorsement against loss and additional hazards that are typical for the property location.

Can I convert the rental property back to my primary residence in the future?

Yes, you can convert your rental property back to your primary residence. However, it’s important to note that DSCR loans are specifically designed for rental properties, so you’ll be required to refinance back to a traditional mortgage option. Before committing to switching back, you should double-check your mortgage terms with your lender to ensure compliance.

How can I determine the market value when converting my primary residence into a rental property?

When converting your home into a rental property, the value is generally based on whichever is lower: its current fair market value or what you originally paid for it, adjusted for improvements and depreciation. It’s important to note that Visio requires an appraisal for all borrowers seeking a loan. The appraiser will ensure the property’s value.

You’ve Lived in It. Now Let It Work for You.

Converting your primary residence into a DSCR rental involves numerous moving parts, and at times, it can feel overwhelming. From securing the right financing to navigating local regulations and updating your insurance, there’s a lot to manage. Using these steps as a guide can help simplify the process and set you up for success.

And when you’re making that transition, it’s worth finding a lender who sees you as more than just another loan, but rather a lender who sees you as a partner and understands your goals and supports your long-term strategy.

As the nation’s No. 1 DSCR lender, Visio specializes in rental property financing. It’s not one of many products; it’s our entire focus. We’ve helped tens of thousands of investors turn their properties into income-producing assets.

Ready to turn your home into a cash-flowing investment? Let Visio help you get started today.