Visio Lending is investing in the tools and technology to help brokers thrive and investors build their rental portfolios. Through our online portal, clients can:

- See the status of current loans, including outstanding documents

- Upload and track loan files

- Easily reach your key Visio contacts, including your Account Executive and Processor

- And more!

We have launched an Online Loan Application on our customer portals for a faster, simpler, and more dependable loan app experience. In this post, we will walk you through the online loan application step by step. For additional guidance on setting up or operating your customer portal, contact your Account Executive.

Online Loan Application Guide

Your guide to navigating the Online Loan Application

You can now seamlessly integrate your loan application with your financial apps through Plaid Assets. Download Plaid Tutorial Here.

Accessing the Loan Application

Accessing the loan application is different for Brokers and Investors.

Brokers

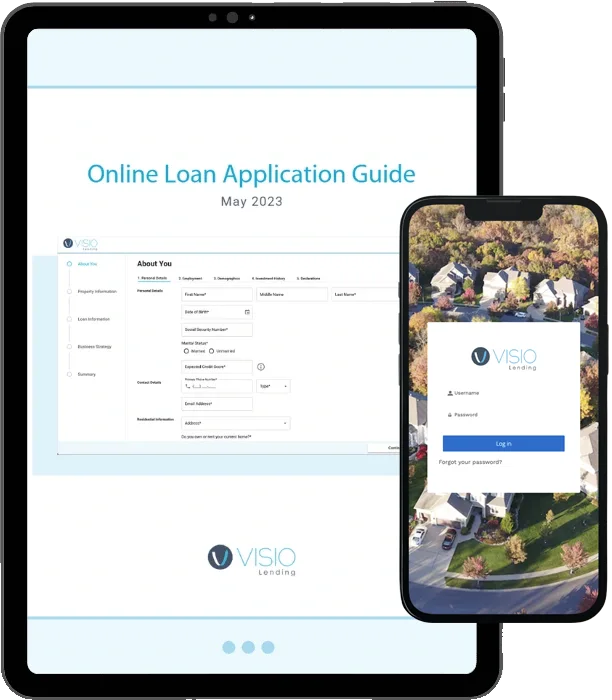

Log in to your Broker Portal. For login help, see our Broker Portal Guide or reach out to your Account Executive. Then click the “Loan Pricing” button on your homepage.

You will be guided through pricing a deal. Once you have priced it, you can select a product and then hit “Select” and then “Start Online LoanApplication.”

Investors

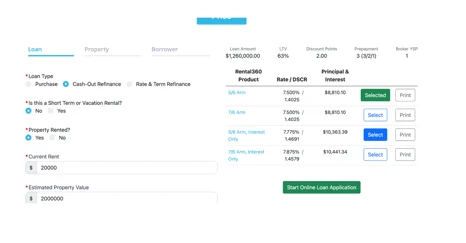

Log in to your Investor Portal. If you have any issues, ask your Account Executive. Once inside, find the loan scenario and click the “Application” button on the far right.

Keep in mind that your Account Executive must prepare the application for you. Once, they do you will be able to access the loan app in your portal.

Completing the Loan Application

The first time you start the application, you will have a wizard introduce and walk you through each item. We will also walk you through the process, and you can find this guide any time through the “Resources Tab” on our main navigation bar.

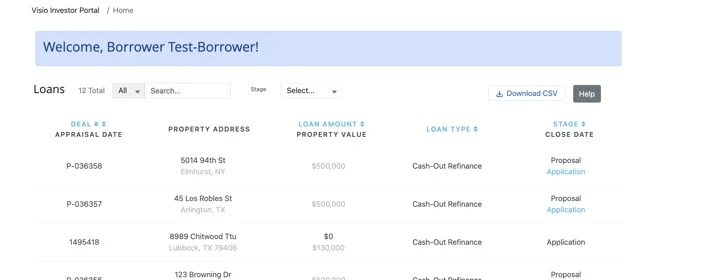

Section 1: About You

In this section, we’ll gather personal details, employment history, demographics, and more details related to the borrower.

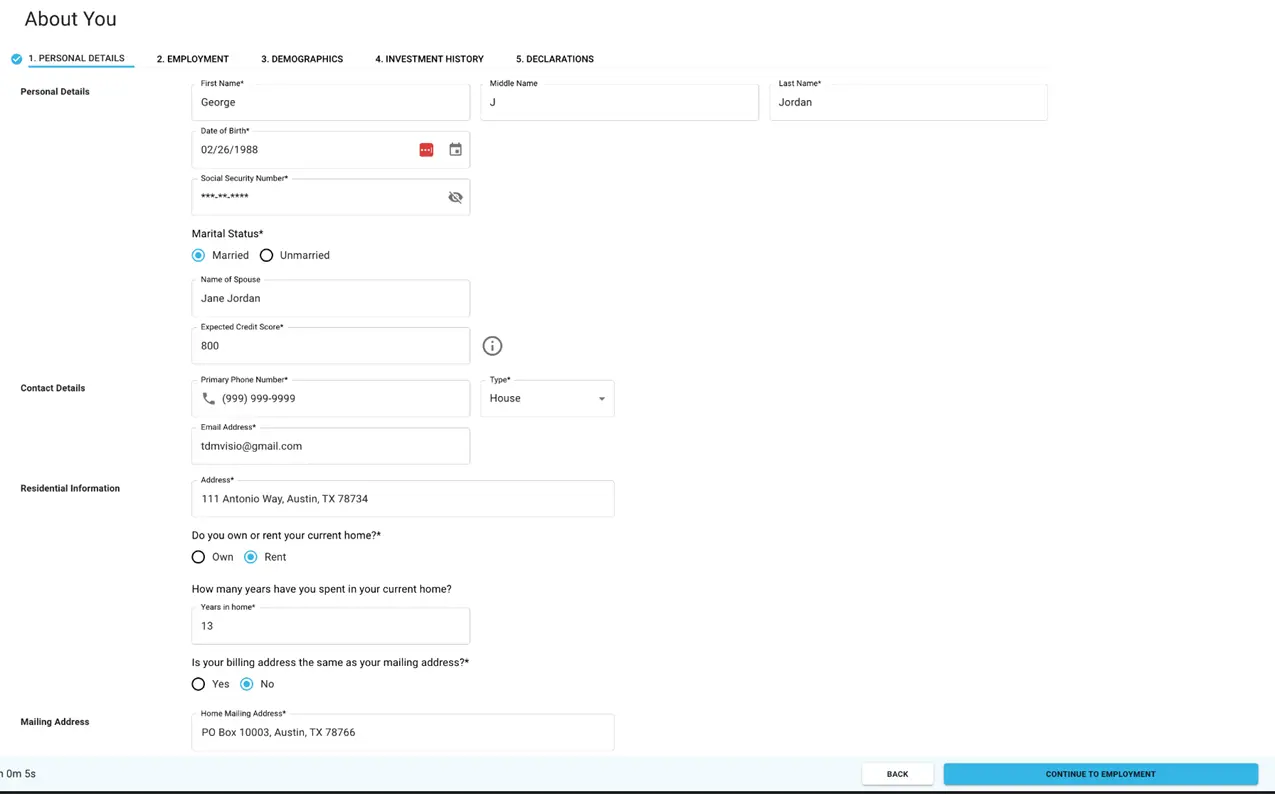

Personal Details

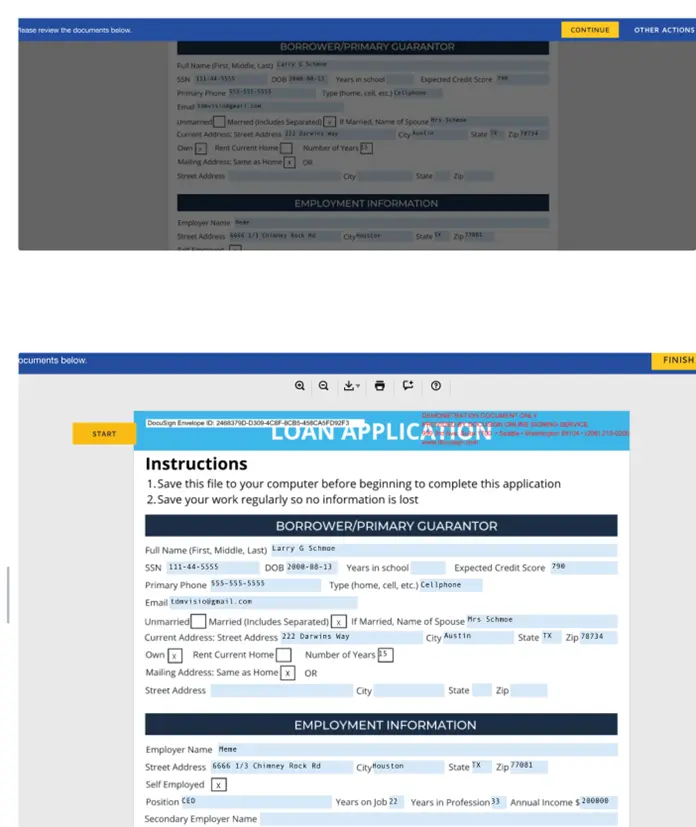

The first section collects all of your (or your borrower’s, if you’re a broker) personal details. Input your (or your borrower’s) name, date of birth, social security number, marital status and contact information. We’ll need a residential address, a mailing address, and a billing address. You can indicate if they are all the same address, so you do not have to put the same address in multiple times. We’ll also ask if you (or your borrower) own or rent your home.

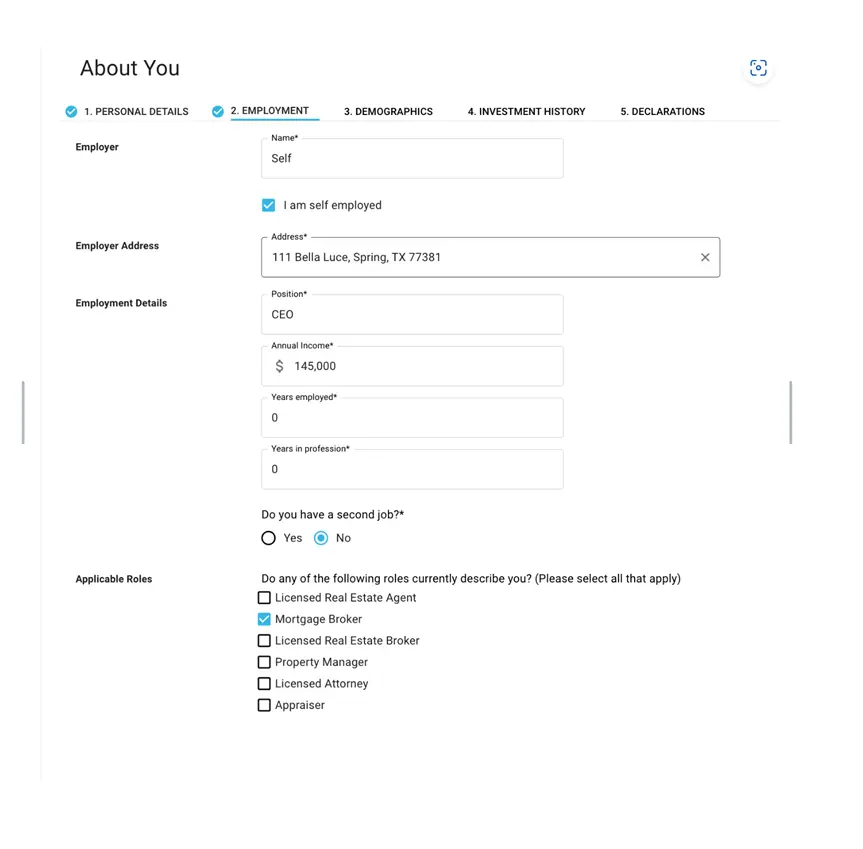

Employment History

Provide yours (or your borrowers if applicable) employment history. This section includes employer name, employer address, position, annual income, years employed and profession. Put “Self” if you (or your borrower) are (is) self-employed. Also, include the information of your (or your borrower’s) second job if applicable. And select any applicable real estate roles from the provided checklist.

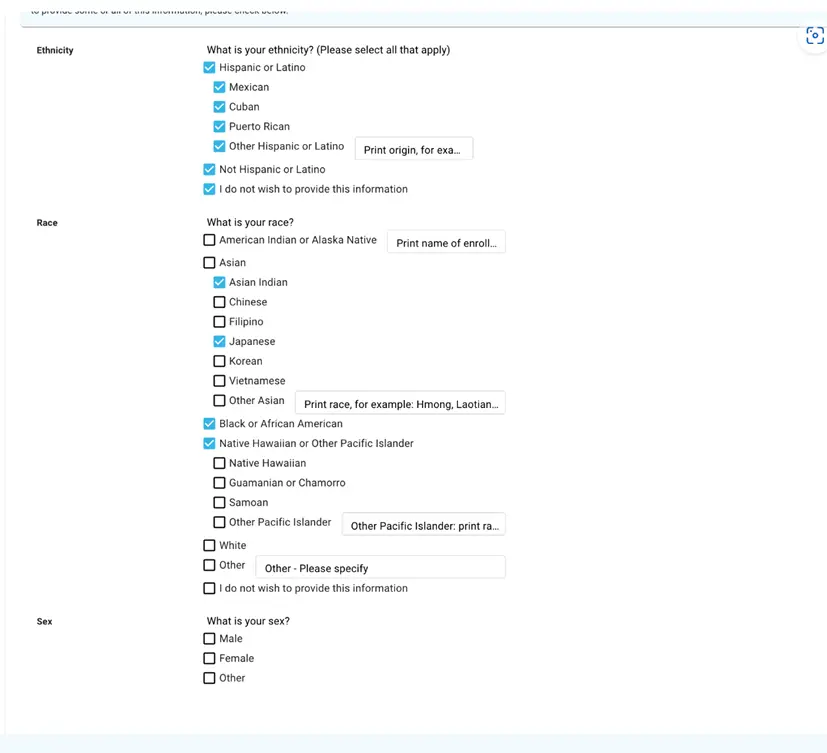

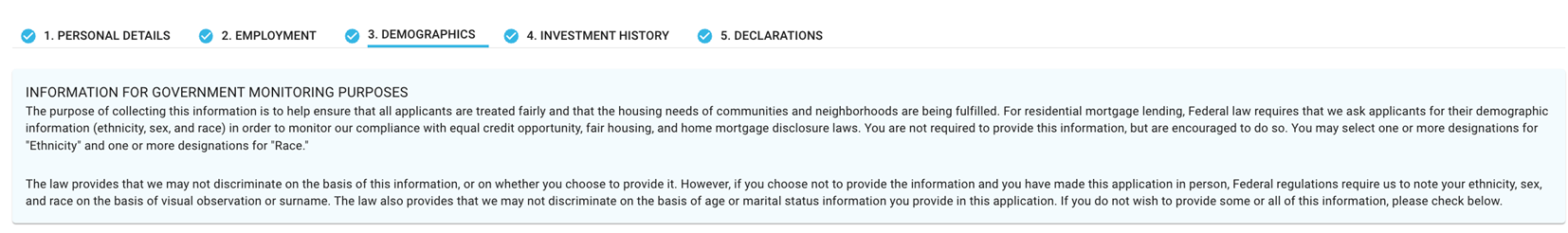

Demographics

Provide your (or your borrower’s) demographic information including ethnicity, race, and sex. We have a disclaimer that explains the purpose of these questions.

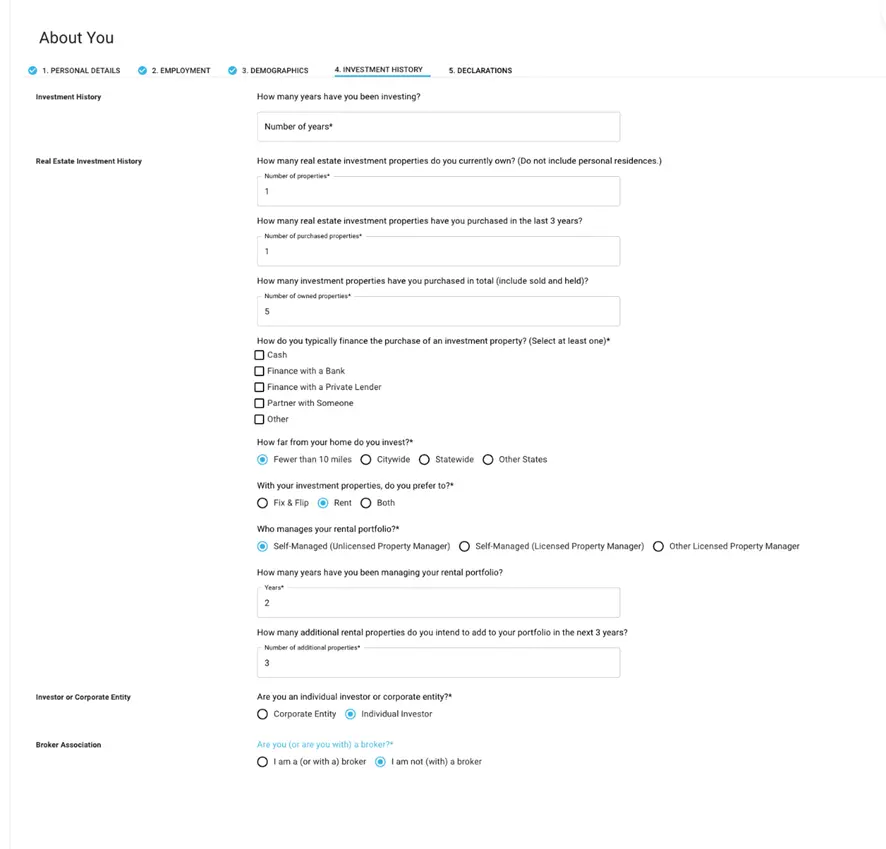

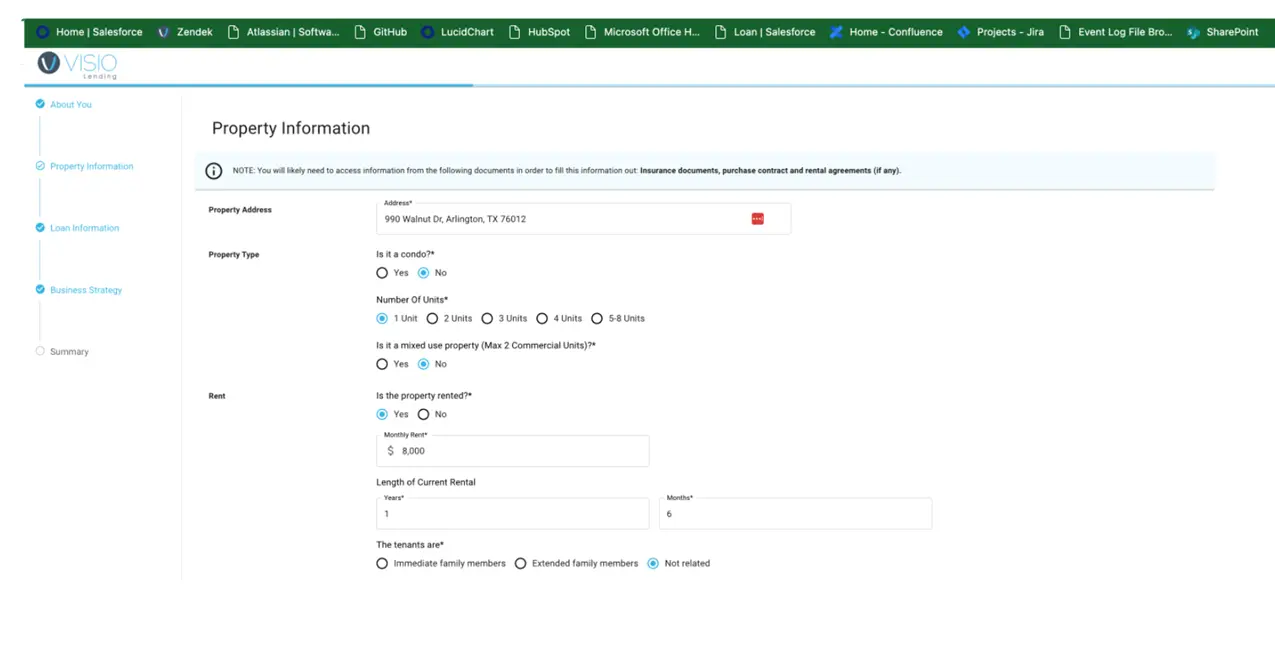

Investment History

Borrower Investment Property History & Property Management Strategies: Provide your (or your borrower’s) investment history in detail, including how many years of experience you (they) have, how many properties you (they) own, how many properties you (they) have purchased in the last three years, and how many properties you (they) have purchased total. We also will ask for details on how you (or your borrower) typically finances properties and manages them.

Broker & Corporate Entity Fields: Additionally in the Investment History section of the loan application, we ask for broker and corporate entity details, if applicable. This is where brokers will indicate that they are working on the loan. If you (or your borrower) are borrowing in a corporate entity, we will ask for the entity name, type, state, and ownership information.

Declarations

In this section, we ask for key legal declarations, such as bankruptcies, liens, lawsuits, etc. If you select yes for any declaration, you will have an opportunity to explain.

Online Loan Application Guide

Your guide to navigating the Online Loan Application

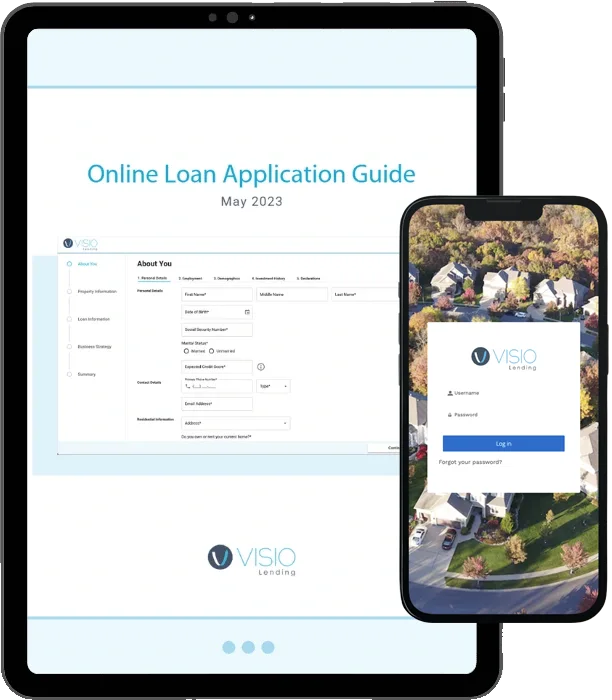

Section 2: Property Information

Here we gather all relevant details on the investment property. Fill out each question regarding the address, if the property is rented and for how much, number of units, estimated value, etc. We also ask for details on judgements, taxes, and liens, if applicable.

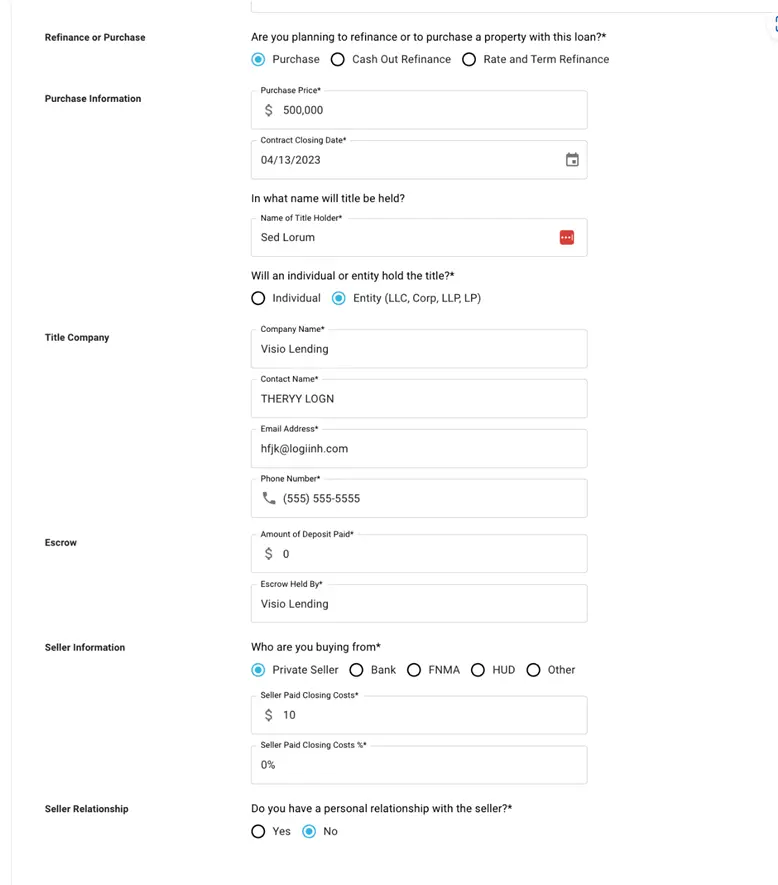

Section 3: Loan Information

In this section, we ask if the loan is a purchase, cash-out refinance, or rate & term refinance. Depending on what you select, you will be asked a series of questions related to the loan type. For instance, for a purchase, we’ll need to know about the purchase price and seller information. For a refinance, we’ll need to know the acquisition information,

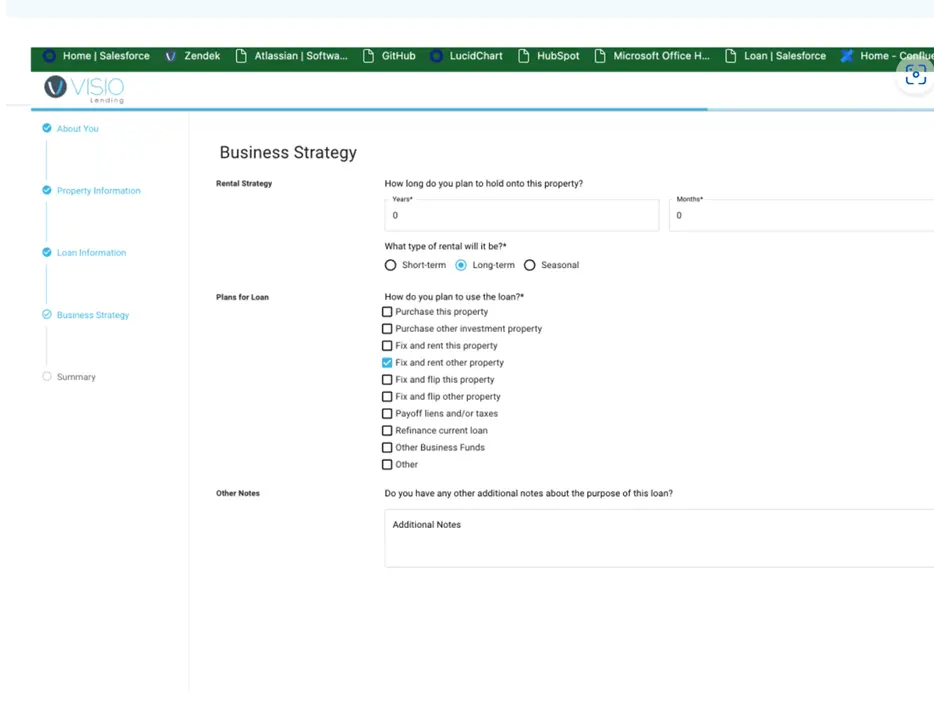

Section 4: Business Strategy

Here we’ll ask about how long you plan to hold onto the property and how long you (or your borrower) plan to rent it out. We’ll also ask how you (or the borrower) plan to use the loan.

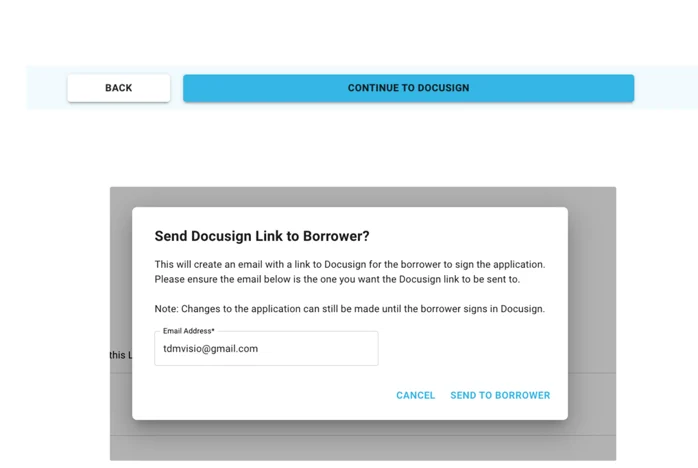

Signing the Application

Here, the process varies for investors and brokers. Brokers will be asked to send a Docusign directly to their borrowers, and borrowers will be asked to send the Docusign to themselves. The password to access the Docusign is the last four digits of the primary guarantor’s Social Security Number.

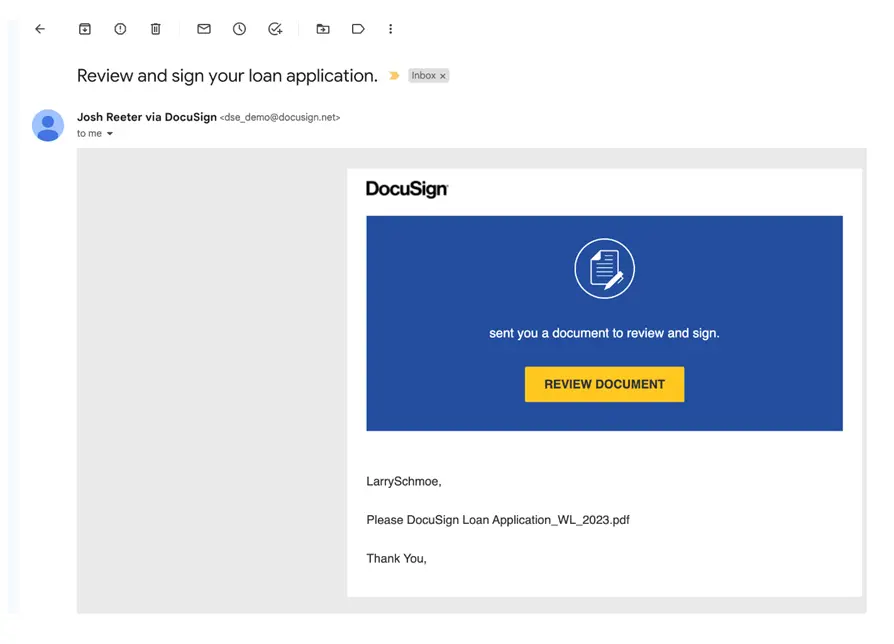

Here is what the email all borrowers will receive looks like:

The borrower will then click on the email and follow the steps to sign the loan application.

Once complete, the borrower will receive an email copy. The loan can be managed at any time through the Broker Portal. For questions or additional guidance, reach out to your Account Executive or their assistant if they have one.

Online Loan Application Guide

Your guide to navigating the Online Loan Application