.png?width=750&height=422&name=Feb%20Blog%20Feature%20Image%20Dump%20(2).png) Flipping real estate can be incredibly lucrative, but real estate investors need to understand how paying taxes on flipping houses works to avoid a very unpleasant tax season.

Flipping real estate can be incredibly lucrative, but real estate investors need to understand how paying taxes on flipping houses works to avoid a very unpleasant tax season.

In this article, we’ll discuss the tax implications of this real estate investment strategy, including what kinds of deductions you can make, the IRS tax regulations, what risks you undertake when house flipping, and how you can rely on professionals for assistance in minimizing your taxes.

.svg) Talk to an Investment Property Expert

Talk to an Investment Property Expert

Understanding the Basics of House Flipping Taxes

The IRS considers the profits of flipping houses as ordinary income, meaning that you pay taxes within your normal income tax rate. You’ll have to pay a self-employment tax, which typically is a rate of 15.3%.

You will also pay federal income taxes and state income taxes, again at your ordinary income tax rate. Federal income tax rates are between 10% and 37%, while state income tax brackets may differ.

There are also some other implications, which include the following.

Short-Term vs. Long-Term Capital Gains

House flips are subject to the self-employment tax because the investment property is held for less than a year. You won’t need to pay a short-term capital gains tax, as you’re already paying self-employment taxes.

However, if you hold onto the property for over a year, you will be subject to the long-term capital gains tax. There are federal capital gains taxes and state capital gains tax, but only if your state already has an income tax.

If you trigger the capital gains tax, you won't have to pay your self-employment tax. There are many ways to lower your capital gains tax and reduce your taxable income. You will need to discuss with a professional whether you are eligible for them — the IRS classifies house flippers as real estate dealers rather than investors, which means they get different tax treatment.

Primary Residence Rule

If you have to hold onto the property for longer than a few years, you can utilize the primary residence rule, meaning you live in the investment property for at least two out of the five years. It’s not a common deduction for house flippers because they try to sell the property in less than a year, but it can be helpful if you are in a slow market.

How to Calculate Taxes on Flipped Houses

If you hold the property for under a year, you will multiply the profit by your ordinary income tax bracket. You will also multiply it by the self-employment tax and then add all these costs together. However, if you hold it for over a year, you exclude the profit from your overall income and only use capital gains.

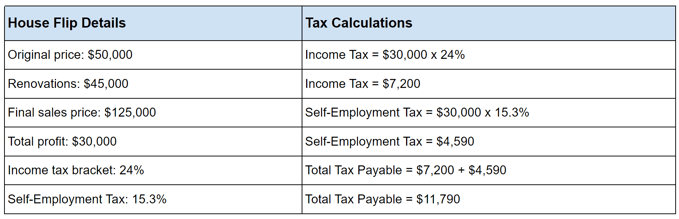

Let’s take a look at the first tax example:

Scenario 1: Property Held for Less Than a Year

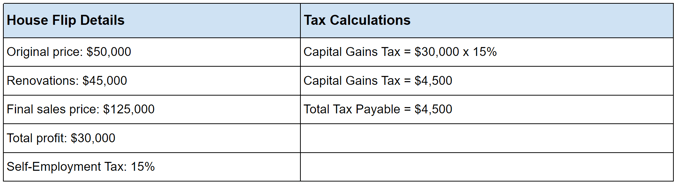

Now, let’s assume you have held the property for more than a year. This is what the calculation would look like; remember that this is not for the rest of your income, taxed at the usual rate, but only for the sales profit.

Scenario 2: Property Held for More Than a Year

As you can see, you benefit immensely from holding property for longer, bypassing self-employment and excluding the sale from your normal income bracket. This doesn’t work for everyone in the house-flipping business, but it can be very helpful to some.

Common Tax Deductions and Credits for House Flippers

There are a number of deductible expenses that you can report to help reduce your tax bill. Some can help you save money before you sell the property, but others can only be claimed after the sale. As you start flipping houses, be sure to meticulously document these expenses to alleviate your tax burden.

Travel Expenses

Things like plane tickets and vehicle expenses, like gas and wear and tear, can be deducted. Not only does this help compensate you for car maintenance, but it can also provide excellent tax benefits if you happen to be working on a house far away from your home.

Office Expenses

These include expenses for a physical place of business, such as rent, utilities, stationary, and office supplies. If you have a home office, you can reduce your income tax proportionate to the square footage of the home office in proportion to the rest of the house.

Business Expenses

Things such as property taxes, building permit costs, and real estate commissions would all be considered business expenses. This often includes the cost of professional memberships and accreditations.

Professional Fees

Legal and accounting fees are considered professional expenses. You can save up on your taxes by deducting real estate attorney and tax professionals' fees.

After-Sale Deductibles

Some tax deductions are only available after selling properties — they're capitalized into the original basis of the house. This includes the purchase price and costs such as building materials, labor, insurance, equipment depreciation, and real estate taxes.

IRS Rules and Regulations for House Flipping

The IRS classifies house flipping gains as active income, not passive income like rental income. This means the real estate investor will pay taxes within their ordinary income tax bracket. Here’s what this means for you.

Flipper Classification

The IRS gives real estate dealer status to every house flipper, which means that professional house flippers are identified the same as those who flip houses as a side gig. Real estate dealers are seen as business entities even if they don’t incorporate. As you’ll be working for yourself, you are subject to self-employment taxes on any windfall you make.

Reporting Requirements

Sole proprietors, LLCs, and S Corps who are flipping houses need to report their net profits quarterly. These estimated taxes are due April 15th, June 15th, September 15th, and January 15th of the following year. You will use a Schedule C form for these estimated taxes.

Consequences of Non-Compliance

Failing to pay house flipping taxes can result in major consequences. You’ll start to accrue interest on the taxes, which can eventually lead to liens on the property and even garnishment of your wages. It’s best to seek good tax advice and ensure you’re paying everything due on your taxable income, even if it’s frustrating.

What Is the Risk of Flipping Property?

While you can make a profit off house flipping, this does not mean it is risk-free. There are a variety of different pitfalls that await the unwary house flipper, especially during tax season. Consider all of these elements before you decide to dive in.

Financial Risks

The most prominent concern for a house flipper is losing money. You may underestimate how much work a house takes before it’s sellable, or you may overpay for construction costs. As commercial properties have higher loan interest, you may be paying more than you should in interest.

It may help to look at all your options, including some alternatives to hard money lenders. If you fail to estimate how much tax you need to pay and then underpay the IRS, you can find yourself with liens on the property.

Legal Risks

There are tight rules on house flipping to protect the market, which includes the Anti-Flipping Rule, which limits how many times a house can be sold. A seller may not have the title to the home, or you may accidentally fall afoul of zoning laws.

Market Risks

It’s possible for the market to drastically change while you’re fixing up the home, leading property values to drop significantly. You may then have to sell at a loss. If this sounds too intimidating, you can always buy a house, fix it up, and then develop a strong rental income by holding it for longer.

Strategies to Minimize Taxes on House Flipping

As income tax can eat into your profits, you need to know how to reduce your tax burden as much as possible. These options can be very beneficial in reducing your taxes.

Holding Periods

If you hold the property for over a year, you will be able to switch out your self-employment tax for long-term capital gains tax, which can be a lower rate if you have a lower sales volume — sometimes as low as 0%.

Legal Entity Structuring

If you structure yourself as an S Corp and pay yourself a “reasonable salary,” you will pay the 15.3% self-employment tax rate on your salary amount. You can also choose between paying yourself a salary and receiving dividends, with dividends being subject to a lower tax rate.

Reinvestment Options

While you may not be eligible for the Section 1031 like-kind exchange, you may be able to use the QOZ program for investments in certain areas as long as you reinvest within 180 days. You can use it to offset losses from other investments, reducing taxes while still making a profit.

Professional Advice and When to Seek It

Working with a qualified tax professional is always a good idea to develop a strong investment strategy. Taxes on a real estate investment can be complicated, especially if you are doing it as a side job. Here are some circumstances in which you should absolutely seek help from a professional familiar with the needs of real estate investors.

Complicated Tax Laws

If your filing status changes for whatever reason during the course of a year, such as getting married or divorced, you will need to discuss how this will change your income tax.

There’s a major difference between self-employment tax rates and capital gains rates, and a tax professional can assist you in determining your next step. You may also not be able to forestall capital gains tax, as these breaks aren’t always possible for a real estate dealer.

Large Investments

A real estate investor who is flipping multiple houses at once should talk to an accountant to untangle the self-employment taxes. This is especially true if some of their capital assets are under a year old while others have been in their possession longer; these are classified differently upon sale.

New House Flippers

If you are new to the business, a tax professional can help explain all of the nuances of tax law to you, such as how to file self-employment tax and how to itemize your deductions. They will be able to help you calculate net profit and discuss the capital gains taxes.