Few investors have the ability to finance investment properties entirely out of pocket, so they turn to rental property loans to secure real estate and generate rental income. However, investment property mortgage rates differ from those for a primary residence mortgage because they are a higher risk for a mortgage lender. It's important to expect and prepare for higher interest rates on investment property mortgages in order to select well-performing properties that will finance your mortgage payments.

In this article, we explain what mortgage rates are, their nuances and types, how to finance them, and what lenders typically look for.

These are the rates at which you can borrow money for an investment property loan from mortgage lenders, such as banks, credit unions, and private lenders. They are a percentage of the overall loan amount that you will pay each month in addition to the principal and, if applicable, the mortgage insurance.

Because investment property interest rates greatly impact the profitability of your rental properties, you should pay close attention to their fluctuations over time. This can assist you in determining when to buy and sell rental properties, as well as when is a good time to refinance your investment property loan for a better rate.

Mortgage interest rates for single-family investment properties are typically 125 bps to 300 bps higher than conventional mortgages. In other words, if the equivalent consumer mortgage rate is 6.5%, the rate for a single-family investment property will be 7.75% to 9.5%.

Rates for investment property mortgages fluctuate greatly with the market's overall performance, and they are closely connected to mortgage rates for residential conventional loans. To get a feel for the potential cost of your investment property loan, you can input the overall loan amount and review what your monthly mortgage payment would look like based on current investment property rates.

There are several reasons why rental property loans have higher interest rates than loans on primary residences. We'll look into all of them below.

Higher risk is the simplest explanation for why interest rates on investment and rental properties are higher than on a primary residence.

The reasoning goes something like this -- an owner-occupier will do everything in their power to make timely payments on their home mortgage to protect their source of physical shelter.

While investors, too, are emotionally attached to their investment properties, the market perceives that investors are more likely to walk away if a deal turns South. The historical performance data supports the market’s perception.

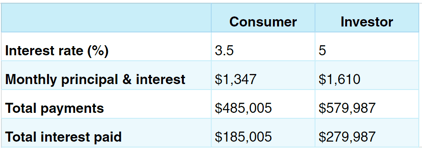

Below, we compare some of the key metrics on a $300,000 30-year mortgage for a consumer and an investor:

In the above example, the investor’s interest rate is 1.5% or 150 basis points more than the consumer interest rate. The investor’s monthly payment will be $1,610, which is $263 or approximately 30% more than the consumer’s monthly payment. Over the life of the loan, the investor will pay more than 50% more in interest than the consumer.

It is an interesting question of whether investors present that much higher risk than a consumer. Part of the explanation goes to the fact that the U.S. government plays an extremely active and supportive role in the U.S. consumer mortgage market. But for the U.S. government’s support of the U.S. consumer mortgage market, consumer mortgage rates likely would be higher and thus the gap to investor mortgage rates likely would be smaller.

A good 30-year investment property mortgage will be 100 to 400 basis points higher than the interest rate on an equivalent consumer or owner-occupier mortgage. A variety of factors (described below) determine the type and source of your investment property loan and where you fall within the wide 100-to-400 basis points range.

It is also important to note that, unlike owner-occupiers, real estate investors care about the rental income potential of a property. Even with a slightly higher interest rate, a good real estate investor still profits monthly.

The rental property mortgage rate is impacted by both general market trends and your personal creditworthiness. The borrower's personal financial details greatly influence conventional investment property mortgage loans, while debt service coverage ratio (DSCR) loans focus more on the income production of investment properties. These are the various factors that impact mortgage rates for investment property loans

|

When purchasing investment property, you need to select the right loan product for your needs, whether that is conventional loans or specialized mortgage products made for investment properties.

Your choice depends on your particular goals as an investor and your financial circumstances. For example, someone purchasing a primary residence that they will later turn into a single-unit investment property may explore conforming loans, such as a VA loan or conventional mortgage. Those with excellent credit scores and the money for a higher down payment might want to buy more investment properties at a time, so they would look into DSCR loans.

The investment property rate will also vary significantly between lenders, so make sure to compare investment property mortgage rates before you come to a decision.

Now, we'll explore the different types of investment property mortgages and what types of rates you can expect from each product.

If you are looking to buy an investment property and you want to compare investment property mortgage rates, you have three different types of rental property loans to choose from, including:

A bank loan is not eligible for sale to or guarantee by a GSE, so the bank has to hold the loan on their balance sheet in their own loan portfolio.

Most local banks focus on financing commercial real estate and small businesses. Some allocate a portion of their assets for residential mortgage lending, including on rental properties. Often these loans are reserved for existing customers.

Bank regulators frown on banks originating and holding long-term mortgages because it is hard for banks to match those mortgages with long-term financing on their balance sheet. So bank loans often amortize over twenty or thirty years, but often include a balloon payment after five or seven years.

The qualification requirements for a bank loan typically are more flexible than for an agency loan. The bank will require you to document your ability to repay the loan. This will include your tax returns, pay stubs (if any), and personal financial statements.

A Non-QM loan, also referred to as a DSCR Loan or investment property loan, will have a full 30-year term and the lender will underwrite the loan based on your credit report and the monthly gross income generated by the investment property rather than your personal income.

Non-QM Loans are not eligible for purchase or guarantee by a GSE, and most banks will not originate or purchase Non-QM investment property loans because they do not include underwriting the borrower’s ability to repay the loan based on their personal income.

If you’re interested in beginning the rental property loan process, contact us today to get started.

While the three methods above are the most popular ways to obtain an investment property mortgage, real estate investors have some other options including:

• Hard money loans: A hard money loan is a short-term option for investment properties. This loan type is typically used for construction projects but can be used for rental properties as well. It's popular with real estate investors for its short term and fast closing but it comes at much higher interest rates compared to a conventional loan.

• Home equity options: If you have a primary residence, you can use a home equity loan or a home equity line of credit to borrow against the equity and purchase an investment property. Keep in mind, your primary residence will be used as collateral when obtaining a home equity loan. It is essential that you keep up with each monthly mortgage payments in order to keep your home.

• Cash-out refinance: Investment property refinancing is a great tool that doesn't necessarily involve your primary residence. It enables investors to pull cash out of an existing property, including an investment property, to finance their next investment. Keep in mind that there will still be a down payment and closing costs associated with the loan.

There are a variety of online sources of mortgage rates for Agency Rates. The table above provides an indication of current rates for primary residences. To compare investment property mortgage rates to get an idea of current rates for each of the rental loan options, take the quoted rate below and then make the following adjustments:

• Agency Loan for a rental property: Add 100 bps (so if the quoted rate is 3%, then add 1%, so you could expect something around 4%)

• Bank Loan: Add 200-400 bps (so if the quoted rate is 3%, expect 5%-7%)

• Non-QM Loan: Add 200-400 bps

Lenders typically also have origination and other fees. Origination fees often are calculated as a percentage of the loan amount and often are presented as “points.” One point is equal to 1% of the loan amount.

Other fees, such as an underwriting fee, may be presented as flat amounts that do not vary with loan amount. Typically, you will be able to trade a higher interest rate for lower fees, particularly origination fees. Conversely, you often can reduce your interest rate if you’re willing to pay higher upfront fees.

Interest rates and fees are important when evaluating how to finance a rental property, but there are other important issues to consider.

|

|

|

Although interest rates are always higher on investment property loans, there are ways you can get a better interest rate.

Every mortgage lender is going to have a minimum credit score requirement, but usually, the higher your credit score, the better the interest rates become. Even though a 640 may qualify you for a mortgage, you'll pay significantly more over time, so work to clean up your credit before you submit an application. Pay down other debts, protest incorrect information on your credit report, and increase the lines of credit available to you.

The rule of thumb for any real estate loan is that the size of the down payment positively affects mortgage rates. In other words, with just a minimum down payment, you get the highest investment property loan rates and vice versa. If you are able to increase your down payment and improve your LTV, you can also improve your rates.

Investment property rates can often be brought down by paying higher fees. This gives you discount points, which lower the rate for the duration of your loan. Investors who plan to buy an investment property and hold onto it long-term will also often buy their rate down. However, if a real estate investor wants to sell the property in the near future, it might not be worth it to buy down the mortgage rate. Keep in mind that a buydown may cost you some other concessions depending on the lender.

If you can't use the above methods to get a better investment mortgage rate, don't worry. There are still ways to ensure your rental property is profitable.

This is the simplest way to cover a higher rate. The more rental income you can charge, the more money you have to make your monthly payments. Ensure that your investment properties have rents that are in line with the local market. Low rents may attract tenants but also cut into your overall profit. Increasing the value of your property will allow you to command higher rents, and it will also improve home equity, providing you with a better payoff in the future.

In addition to making more money, reducing your expenses will optimize your monthly gross income. Similar to your primary residence, you can fight your taxes each year:this typically involves lodging a valuation complaint, arguing that your property has been overvalued and thus is subject to higher taxes than it should be. You can also shop for insurance policies to find the best possible rate.

Hold forever or sell at the right time; A dramatically simplified qualification process

Underwritten using short-term rents; ideal for business owners and self-employed borrowers

Visio Lending is the nation's premier lender for buy and hold investors offering, long-term loans for SFR rental properties, including vacation rentals.

All rights reserved. Copyright 2024. All loans are originated by Visio Financial Services Inc. (“VFS”) or Investor Mortgage Finance LLC (“IMF”). VFS is licensed by the Arizona Department of Financial Institutions as an Arizona Mortgage Banker, license number 1010600 as well as by the California Department of Financial Protection and Innovation as a California Finance Lender, license number 60DBO-56345. VFS’s company NMLS ID number is 1935590. IMF is licensed by the Arizona Department of Financial Institutions as an Arizona Mortgage Banker, license number 1034031 as well as by the California Department of Financial Protection and Innovation as a California Finance Lender, license number 60DBO-160501. IMF’s company NMLS ID number is 2297729. For more information about the use of our Website, please see our Terms of Use and Privacy Policy.